Table of Contents

Facing a state tax audit can be daunting, leaving residents of Washington, D.C., and Maryland with numerous questions and concerns. Understanding the intricacies of the audit process and your rights as a taxpayer is crucial for a smooth and successful resolution.

This comprehensive guide will delve into the specifics of state tax audits in both D.C. and Maryland, equipping you with the knowledge you need to navigate this complex terrain. Whether you’re facing a Maryland tax audit or require the assistance of a Washington, D.C., tax audit attorney, knowing your options and seeking professional guidance can make all the difference.

Understanding State Tax Audits

Successfully handling a state tax audit requires a foundational understanding of what they entail and why they occur. We’ll start by exploring the core aspects of state tax audits, shedding light on their purpose and frequency and the selection process.

What Is a State Tax Audit?

A state tax audit is a review conducted by the state’s tax authority to verify the accuracy of a taxpayer’s return and ensure compliance with state tax laws. The objective is to identify any discrepancies, underreported income, or unclaimed deductions that may affect tax liability.

State tax audits differ from federal tax audits conducted by the Internal Revenue Service (IRS), as they focus solely on state tax returns and adherence to specific state regulations.

Do All States Audit Tax Returns?

Taxpayers in all 50 states are subject to state-level tax audits, though the selection process can vary. Some returns are chosen randomly, while others may be flagged due to specific triggers, such as:

- Significant discrepancies between reported income and information from third-party sources (e.g., W-2s, 1099s).

- Unusually high deductions or credits claimed.

- Participation in certain industries or business activities is known for higher audit risks.

A history of non-compliance or tax issues can also trigger an audit in most states.

How Common Are State Tax Audits?

The frequency of state tax audits can vary depending on several factors, including budget constraints, available resources, and state-specific priorities. Generally, the likelihood of being audited is relatively low. Even so, understanding the audit process and potential triggers can ensure that you’re prepared and minimize your risk in the event that you’re selected.

State Income Tax Audits in D.C. and Maryland

Both Washington, D.C., and Maryland have established procedures for conducting state income tax audits to ensure compliance with their respective tax laws. Understanding the specific steps involved in each jurisdiction’s audit process is crucial for taxpayers facing such examinations.

Here’s an overview of the distinct approaches officials in D.C. and Maryland take when handling state income tax audits.

State Income Tax Audit Process in D.C.

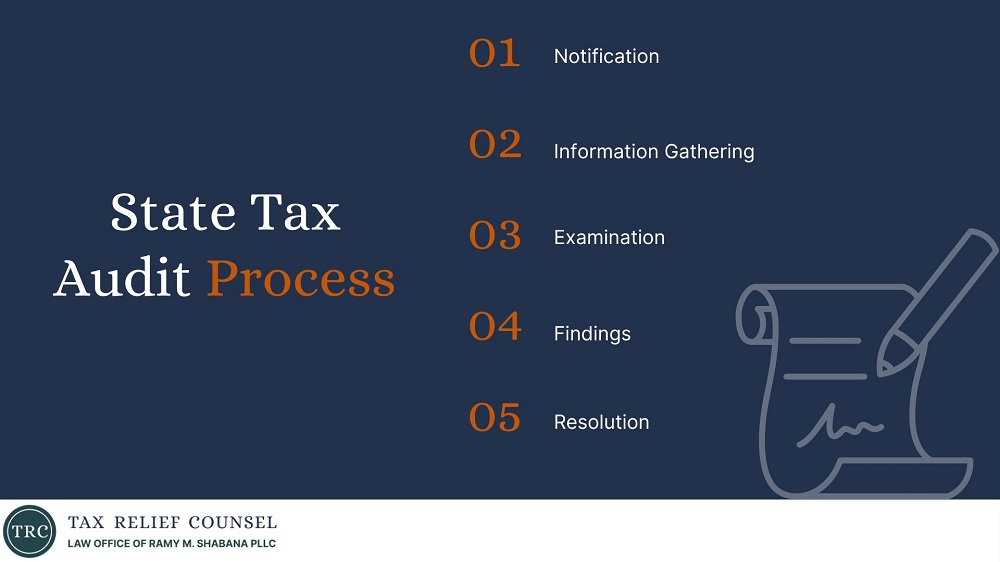

The Office of Tax and Revenue (OTR) oversees state income tax audits in Washington, D.C. The agency’s process typically involves the following steps:

Notification

The OTR will notify you by mail if your return is selected for an audit. The notice will specify the type of audit and the tax years under review and provide instructions for responding.

Information Gathering

You’ll be required to provide documentation supporting the information on your tax return. This may include income statements, receipts, and expense records.

Examination

An auditor will review your documents and potentially request additional information or clarification. This may occur through a desk audit (conducted by mail) or a field audit (conducted in person at your place of business or the OTR office).

Findings

The auditor will determine whether any adjustments to your tax liability are necessary. You’ll receive a report outlining the findings and any proposed changes.

Resolution

If you agree with the findings, you’ll be required to pay any additional tax owed. If you disagree, you have the right to appeal the decision.

State Income Tax Audit Process in Maryland

The Comptroller of Maryland oversees state income tax audits in the state. The process is similar to that employed in D.C., with general steps involving notification, information gathering, examination, findings, and resolution. However, there may be slight variations in procedures and timelines.

Worried About a Potential State Tax Audit?

Our tax attorney can help you prepare and guarantee compliance. Contact Tax Relief Counsel today for a free consultation to protect your financial well-being.

Call Me Personally

Other Types of State Tax Audits

While income tax audits are a common concern for many individuals and businesses, it’s important to recognize that state tax audits encompass a broader range of tax types. Depending on your specific profession, circumstances, and activities, you may be subject to audits related to various other state-level taxes, including the following.

Sales Tax Audits

Businesses that collect sales tax on goods or services are responsible for ensuring proper collection, reporting, and remittance of these taxes to the state. Sales tax audits examine a company’s sales tax records to verify compliance and identify any discrepancies or underpayments.

The Streamlined Sales Tax Governing Board provides information and resources regarding sales tax administration and audits.

Property Tax Audits

Property taxes are based on the assessed value of real estate or personal property. Audits related to property tax may be conducted to confirm accurate property valuations and proper calculation of tax liabilities. This can be particularly relevant in areas with fluctuating property values or complex assessment methods.

The International Association of Assessing Officers (IAAO) offers helpful information and resources related to property tax assessment and administration.

Unemployment Tax Audits

Businesses pay unemployment taxes to fund state unemployment insurance programs. Unemployment tax audits verify that companies are accurately reporting their employee wages and paying the correct amount of unemployment taxes.

For more information on unemployment insurance and related tax regulations, visit the website of the U.S. Department of Labor.

Excise Tax Audits

Excise taxes are levied on specific goods and services, such as fuel, alcohol, tobacco, and certain luxury items. Businesses involved in the sale or distribution of these goods may be subject to excise tax audits to ensure compliance with tax regulations and proper payment of taxes.

The Alcohol and Tobacco Tax and Trade Bureau (TTB) provides information and resources related to federal excise taxes on alcohol, tobacco, firearms, and ammunition.

Being aware of the various types of state tax audits can give you the confidence that you’re complying with state tax laws across different areas of your financial activities.

What Happens When You Get Audited by the State?

Receiving a state tax audit notification can cause uncertainty, even anxiety. Knowing how to respond effectively and understanding the potential outcomes can alleviate stress and make for a smoother experience.

Responding to a State Tax Audit Notice

If you receive a state tax audit notice, it’s important to remain calm and take prompt action. Respond to the notice within the specified timeframe and cooperate fully with the auditor’s requests. Gather all relevant documentation to support the information on your tax return, and be prepared to answer any questions the auditor may have.

Potential Outcomes of a State Tax Audit

The outcomes of a state tax audit can differ based on its findings. Possible results include:

- No Change: The audit may confirm the accuracy of your return, meaning there will be no changes to your tax liability.

- Additional Tax Owed: If the audit reveals underreported income or unsubstantiated deductions, you may have to pay additional taxes plus potential penalties and interest.

- Refund: In the best-case scenario, the audit may reveal that you overpaid your taxes, resulting in a refund.

It bears repeating that if you disagree with the audit findings, you have the right to appeal the decision through the state’s established appeals process.

Minimizing Your Risk and Seeking Professional Help

The idea of facing a state tax audit can be intimidating. Fortunately, you can improve your chances of a favorable outcome by taking proactive steps and making informed decisions.

Tips for Preventing State Tax Audit Issues

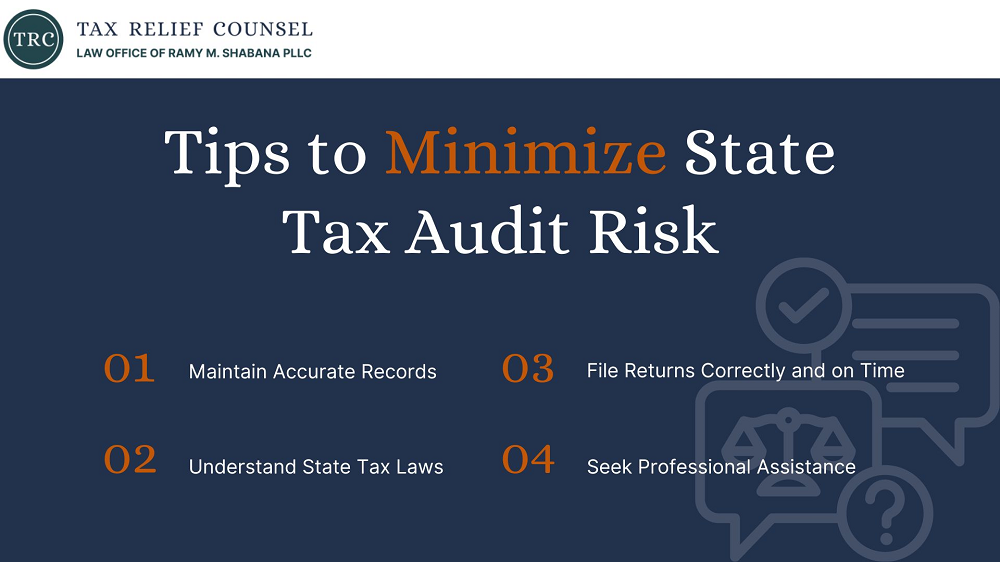

While there’s no guaranteed way to avoid a state tax audit, implementing these best practices can significantly minimize your risk:

- Maintain Accurate Records: Keep meticulous records of your income and expenses, including receipts, invoices, and supporting documentation.

- Understand State Tax Laws: Stay informed about the tax laws and regulations in your state to ensure compliance with filing requirements and deduction eligibility.

- File Returns Correctly and on Time: Submit accurate tax returns by the designated deadlines to avoid penalties and potential audit triggers.

- Seek Professional Assistance: Consult a qualified tax professional for guidance on complex tax matters or answers to any questions you have regarding your return.

A skilled tax attorney can help you get ready for your impending audit and overcome any obstacles that present themselves along the way.

Benefits of Hiring a Tax Attorney

Undergoing a state tax audit can be challenging, especially if you’re unfamiliar with tax laws or the audit process. A tax lawyer can provide valuable assistance by performing the following duties:

- Representation: Acting as your advocate, communicating with auditors on your behalf, and protecting your rights as a taxpayer.

- Negotiation: Negotiating with tax authorities to minimize any potential tax liabilities or penalties.

- Appeals: Guiding you through the appeals process if you dispute the audit findings.

Ramy Shabana, founder of Tax Relief Counsel, is licensed in both the District of Columbia and Maryland and has ample experience successfully assisting clients with audit-related matters.

Give Yourself a Fighting Chance in Your State Tax Audit

By maintaining accurate records, staying current on state tax laws, and seeking professional assistance when needed, you can come out the other side of a state tax audit with your financial security intact.

If you’ve received a state tax audit notification or have concerns about your tax compliance, don’t hesitate to contact Tax Relief Counsel today. We’re committed to representing clients in Washington, D.C., and Maryland, providing dependable guidance and support throughout the audit process.

Schedule a free consultation today, and let us help you achieve the best possible outcome for your situation.