Tax Relief Counsel:

Trusted FBAR Lawyer

As a trusted FBAR lawyer, Tax Relief Counsel is your dependable ally in navigating the complexities of foreign bank account reporting. Safeguard your financial interests with the help of Tax Relief Counsel — your peace of mind is our highest priority.

Trusted FBAR Lawyer in Washington, D.C.

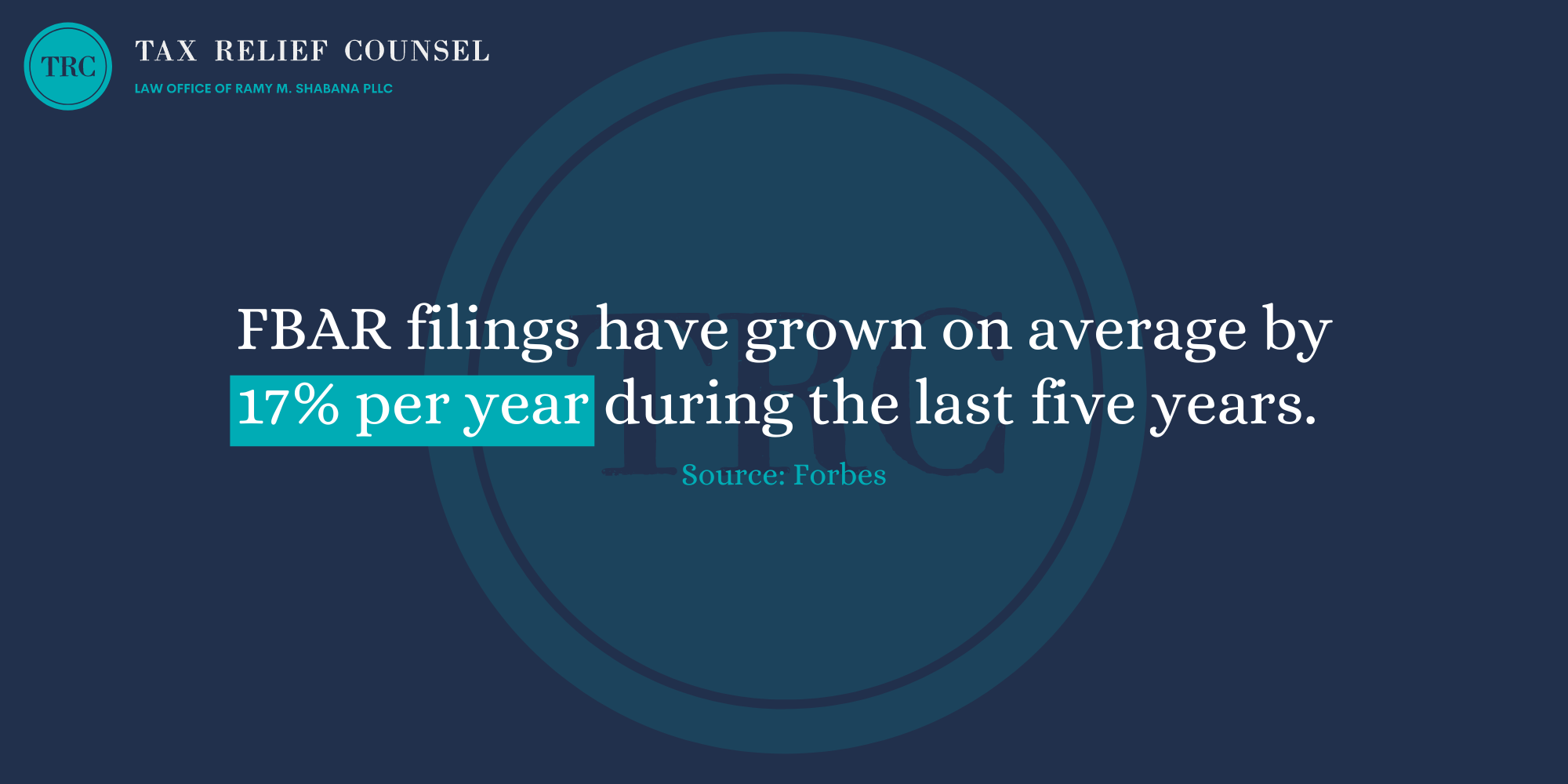

Individuals who have certain financial assets overseas are required to report them annually to the United States Department of the Treasury using FinCEN Form 114, also known as Reports of Foreign Bank and Financial Accounts (FBAR). Such reporting is mandatory for American taxpayers who exceed a certain amount of assets held overseas in a given year.

The government uses these reports to prevent tax evasion, but sometimes, innocent mistakes can trigger an investigation. If you have concerns about FBAR reporting, consult our experienced FBAR lawyer in Washington, D.C.

The experienced tax law professionals at Tax Relief Counsel can review your foreign accounts and determine whether you might be at risk of penalties. Contact our office today to arrange a free consultation and learn more about how we can help.

What Is FBAR?

FBAR, or FinCEN 114, is a form taxpayers must file with the IRS to disclose offshore bank accounts. It’s a recent replacement of the previous version of the foreign bank account reporting form, TD F 90-22.1.

If you have control over a foreign financial account, such as a bank account or mutual fund, and it exceeds certain thresholds, you may be required to report it annually to the Department of Treasury by submitting FinCEN 114 electronically. The Bank Secrecy Act (BSA) is the law that makes this reporting mandatory.

Requirements for FBAR Compliance

Many U.S. citizens and residents are required to file FBAR reports, including domestic business entities and foreign residents with lawful status, trusts, and estates.

These compliance requirements aren’t limited to U.S. citizens. “U.S. Persons” who meet the annual aggregate total threshold for filing may have an FBAR reporting requirement. The Financial Crimes Enforcement Network (FinCEN) defines “U.S. Persons” as:

“United States citizens (including minor children); United States residents; entities, including but not limited to corporations, partnerships, or limited liability companies created or organized in the United States or under the laws of the United States; and trusts or estates formed under the laws of the United States.”

It’s important to note that the FBAR requirement only applies to foreign financial accounts, not properties. Additionally, only accounts with a value of more than $10,000 must be reported under federal law. This value is based on the total of all accounts on any given day. If required to file an FBAR, taxpayers must report all foreign accounts, regardless of their individual balances.

Don't File Your FBAR Alone — Get a Free Consultation Today

Reporting foreign bank account values can be complex, even stressful. Schedule a consultation with our experienced tax attorney today to find the best path forward.

Call Me Personally

Penalties for Willful FBAR Omissions

U.S. taxpayers must file their FBAR by June 30th every year if they have foreign accounts with a total balance over $10,000. It’s critical to provide accurate information. Otherwise, you risk facing tax charges. If you accidentally fail to comply with FBAR, you may be fined up to $10,000.

This amount can be applied for each violation. In other words, a $10,000 fine can be imposed every year the account wasn’t reported. Generally, the IRS can review up to three years of records for unintentional omissions.

If you elect not to file FBAR when you have a duty to do so, it may be considered a willful act and result in harsher penalties.

This behavior applies to individuals who are aware of their responsibility to file FBAR but purposefully neglect to do so. Additionally, taxpayers who intentionally avoid learning about their legal obligations can also be seen as acting willfully. Ultimately, willfulness is characterized by knowingly disregarding a legal duty.

If a taxpayer purposely doesn’t fulfill their FBAR obligations, they could be penalized even more severely.

The penalty could be as high as a $100,000 fine or 50% of the original balance, whichever is greater. Also, similar to the penalty for non-willful cases, each violation is separately punishable. In cases of willful non-compliance, the IRS can investigate up to six years of past records.

The penalties for willful FBAR cases are often higher than the actual account balance. If you’re facing potential FBAR penalties, it’s highly recommended that you have an FBAR attorney in your corner.

|

|

Potential Penalties

|

Notes

|

|---|---|---|

|

Non-Willful Non-Compliance

|

Up to $10,000 per year*

|

IRS can review up to three years of records

|

|

Willful Non-Compliance

|

Up to $100,000 or 50% of the original balance

|

IRS can investigate up to six years of past records

|

*Penalties are subject to inflation

Taxpayers May Also Have a FATCA Disclosure Duty

In addition to U.S. taxpayers revealing their foreign assets and accounts, the Foreign Account Tax Compliance Act (FATCA) mandates that foreign banks and financial institutions furnish information regarding U.S.-associated accounts. The government employs this data to identify taxpayers who may have neglected their disclosure responsibilities.

Some taxpayers may only need to report their accounts under FBAR, while others will need to report under both FBAR and FATCA. Although both sets of regulations require the reporting of foreign accounts, FATCA has a more comprehensive list of assets that must be disclosed.

Moreover, while the FBAR reporting threshold remains constant, the FATCA filing obligation threshold varies based on an individual’s tax filing status and residency status.

Generally, individuals who reside within the U.S. and file singly must report at a lower threshold. Married taxpayers filing jointly and those who live abroad are allowed higher reporting thresholds for foreign assets before being obligated to disclose under FATCA.

Unsure About Your Tax Situation and Compliance?

Our tax attorney is here to offer clarity. Reach out today to discuss your case confidentially.

Call Me Personally

Set Up a Confidential Case Review Today

Consult our experienced FBAR lawyer to find the best tax solution for your situation.

Call Me Personally

How Our FBAR Lawyer Can Help You

FBAR regulations are intricate and involve complex rules, thresholds, and reporting requirements. As such, they can be difficult to understand and act on.

Tax Relief Counsel is your trusted partner in dealing with the nuances of foreign bank account reporting. Here are some of the ways we can assist.

Legal Guidance

Our seasoned tax attorney provides reliable legal guidance on FBAR regulations, which can help ensure that your report is accurate and complies with all relevant laws.

Filing Assistance

We offer hands-on support in preparing and filing FBARs accurately and punctually. We understand the particulars of the filing requirements and can diligently handle the process on your behalf.

Penalty Mitigation

We work tirelessly to negotiate on our clients’ behalf to secure favorable outcomes, and we’ll do everything in our power to limit the penalties you face for your possible omissions, willful or otherwise.

Crisis Resolution

If you’re struggling with an FBAR-related crisis, we’re here to take swift legal action and provide effective solutions.

Why Choose

Tax Relief Counsel?

Discover the many benefits of choosing Tax Relief Counsel for your tax law needs.

Worldwide Tax Aid and Legal Representation

We proudly serve clients around the country and the world.

Flat-Fee Turnkey Services

Take advantage of our transparent, affordable flat-fee structure to get full-service tax and legal strategies tailored to your unique circumstances.

Client-Centered Focus

Your satisfaction and financial security are our top priority. We guarantee clear communication and prompt response times throughout the process.

FAQs

Are There Exceptions to FBAR?

You may not have to report certain accounts and assets under FBAR. An account held by a U.S. military banking facility is an example of one such exception. That said, you do need to report assets held in overseas pensions and retirement plans.

Understanding FBAR compliance requirements and exceptions can be complicated. To avoid potential issues, seek assistance from a qualified FBAR lawyer in Washington, D.C., who understands overseas bank accounts.

When Is FBAR Due? What Is the FBAR Deadline?

If a taxpayer meets the foreign asset threshold, they must satisfy the reporting requirements each year by submitting an FBAR online via the FinCEN website. Be aware that FBAR isn’t filed together with tax returns, unlike other asset reporting requirements.

The deadline to submit an FBAR is April 15 of the next year after the reporting period. However, FinCEN allows an automatic extension until October 15 without the need for a request. The agency has also granted further automatic extensions to victims of natural disasters in the past.

For advice on how to report foreign bank accounts and address past reporting issues, schedule a consultation with Ramy Shabana, the skilled FBAR attorney at Tax Relief Counsel.

What FBAR Amnesty Programs Are Available to U.S. Taxpayers?

There are several FBAR amnesty programs available for U.S. taxpayers who need to report foreign financial accounts and assets.

Voluntary Disclosure Program (VDP)

This program is intended for taxpayers with unreported foreign accounts, assets, investments, and income. It allows them to disclose these holdings to the IRS and thereby become compliant. It’s a continuation of the traditional VDP program that’s been around for many years.

Streamlined Filing Compliance Procedures (SFCP)

Introduced in 2014, the SFCP includes the Streamlined Domestic Offshore Procedures (SDOP) for U.S. residents and the Streamlined Foreign Offshore Procedures (SFOP) for foreign residents. This program is for taxpayers who are non-willful in their failure to report foreign financial accounts.

Delinquent FBAR Submission Procedures (DFSP)

Delinquent FBAR submission procedures may be an option for taxpayers who haven’t filed a required FBAR but have no substantive changes to their tax returns. Currently, the IRS offers a penalty waiver for eligible taxpayers under this program.

How Can the IRS Learn About a Foreign Account?

The IRS can be made aware of foreign bank accounts and assets in any number of ways, including the following:

FATCA Reporting

Over 110 countries and 300,000-plus foreign financial institutions report U.S. account holder information to the IRS under FATCA. The IRS receives this data effortlessly, making it one of the most straightforward ways to detect foreign accounts.

Whistleblowers

Whistleblowers can now claim rewards for disclosing FBAR balances, making it crucial to report all foreign accounts and assets and choose your associates wisely.

IRS Audits

IRS audits are always a potential risk, particularly involving FATCA and FBAR scrutiny. Inaccurate or intentional misrepresentations during an audit can lead to more severe consequences.

Voluntary Disclosure/Amnesty by a Third Party

Voluntary disclosure may expose co-owners of foreign accounts, even if some partners attempt to stay hidden. Identifying joint account holders can create problems for others involved.

J-5 Subpoena

The United States is part of the international task force J5, which targets offshore tax evasion. Subpoenas help uncover evidence of undisclosed foreign assets and transactions.

These methods illustrate the IRS’s vigilance in detecting foreign accounts and underscore the crucial importance of accurate reporting and compliance.

What’s the Difference Between an Audit and an Examination?

An IRS audit is a formal investigation initiated by the IRS to thoroughly review a taxpayer’s financial records and returns, often prompted by specific concerns or questions regarding compliance with federal tax laws.

By contrast, an examination is a more general term not limited to the IRS but also potentially involving other tax authorities that can encompass various reviews or checks of a taxpayer’s financial information. While audits are official and typically in-depth, examinations can vary in scope and formality.

Have Questions?

Get a Free Consultation!

If you’re facing FBAR challenges, our skilled tax attorney can provide a solution. Reach out to our team today to schedule a no-cost consultation.