Have you found yourself in a frustrating situation with the IRS, feeling like you’re stuck between a rock and a hard place? You’re not alone. That feeling of vexation, even oppression, has led many taxpayers to wonder whether they can sue the IRS. While the idea might sound far-fetched, it’s not impossible.

This article will detail the relevant legal options and limitations when it comes to taking legal action against the Internal Revenue Service.

Table of Contents

Understanding the IRS and Its Role

The Internal Revenue Service (IRS) is the federal agency responsible for enforcing tax laws and collecting taxes in the United States. As a powerful government agency, the IRS has broad authority to audit, assess, and collect taxes. But what happens when the IRS makes a mistake or acts unfairly? Do taxpayers have a legal avenue to push back?

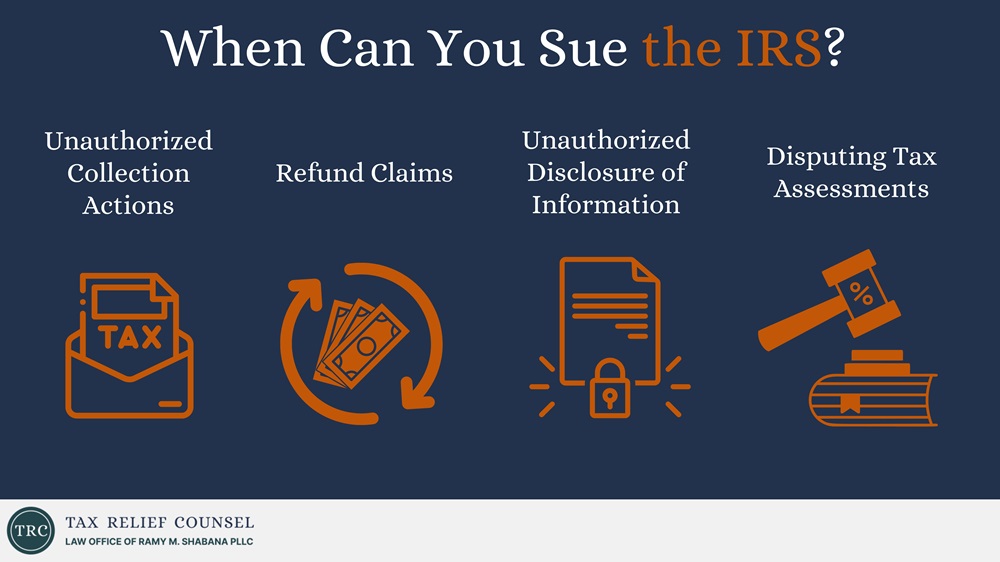

When Can You Sue the IRS?

Can you sue the IRS? The short answer is yes — with several caveats. Legal actions against the IRS are categorized based on specific circumstances and must follow stringent guidelines. Here are the primary scenarios where you might consider suing the IRS.

Unauthorized Collection Actions

One of the most common reasons taxpayers sue the IRS is for unauthorized collection actions. If the IRS continues to pursue taxes from you in violation of the Taxpayer Bill of Rights, you might have grounds for a lawsuit. This can include situations where the IRS garnishes your wages or levies your bank account without proper notice.

Refund Claims

If the IRS denies your claim for a tax refund or fails to issue your refund within a reasonable time, you can file a lawsuit in the United States District Court or the United States Court of Federal Claims. These lawsuits aim to compel the IRS to pay the correct amount owed to you.

Unauthorized Disclosure of Information

The IRS is required to keep your tax information confidential. If an agent unlawfully discloses your tax return information, you can sue the agency for damages under the Internal Revenue Code.

Disputing Tax Assessments

If you disagree with a tax assessment, you can challenge it in the United States Tax Court. This court provides an independent forum for taxpayers to resolve disputes with the IRS without having to pay the disputed amount first.

Steps to Take Before Suing the IRS

Before you rush off to file a lawsuit, there are several important steps you’ll need to take. Lawsuits against the IRS are often considered a last resort. Here’s what you should do first.

Exhaust the Administrative Remedies

You must exhaust all available administrative remedies prior to pursuing legal action against the IRS. That means you need to go through the IRS’s appeals process and give the agency a chance to resolve the issue internally. The Taxpayer Advocate Service can assist you in navigating this process.

File a Formal Claim

For refund claims, you need to file a formal claim with the IRS using the appropriate forms, such as Form 843 for the refund of taxes, interest, and penalties. Make sure you provide all necessary documentation and follow the IRS’s guidelines to the letter.

Legal Forums for Suing the IRS

Once the administrative alternatives are unsuccessful, you can attempt to take your case to court. The main courts where you can sue the IRS include the following:

United States Tax Court

The United States Tax Court is a specialized court that handles tax disputes between taxpayers and the IRS. It’s an independent forum where you can challenge IRS decisions under the law. Tax Court judges are experts in tax law and can therefore provide fair hearings for taxpayers.

United States District Court

If you’re seeking a refund or challenging unauthorized collection actions, you can file a lawsuit in a United States District Court. These courts are set up to handle a broad range of federal cases, including tax disputes.

United States Court of Federal Claims

The United States Court of Federal Claims hears claims against the federal government, including tax refund cases. This court can be a good option if you’re seeking monetary damages from the IRS.

Hiring a Tax Attorney

Filing a lawsuit against the IRS is a complex task, one that requires dependable legal assistance. Here are a few reasons why hiring a tax attorney is crucial.

Extensive Knowledge of Tax Law

Tax attorneys possess technical knowledge of tax law and the federal court system. They can help you understand the nuances of your case and develop a strong legal strategy.

Courtroom Representation

An experienced attorney will advocate for you in court, presenting your case effectively and championing your rights. They can also handle the court costs and procedural requirements, which can be time-consuming and confusing for non-lawyers.

Settlement Negotiation

Many disputes with the IRS can be settled without going to court. A tax attorney can negotiate a fair settlement on your behalf, potentially saving you time, money, and stress.

Potential Outcomes of Suing the IRS

Victory is never guaranteed when you file a lawsuit against the IRS. Here are some potential outcomes to consider.

Winning Your Case

If you win your case, the IRS will be required to take corrective action, such as issuing a refund, ceasing unauthorized collection actions, or compensating you for unjust losses.

Losing Your Case

If you lose your case, you’ll likely be responsible for the entire balance of the disputed tax amount, plus interest and penalties, along with whatever legal fees you’ve incurred. As such, it’s wise to weigh the risks before proceeding with legal action.

Settling Your Case

You might also be able to reach a settlement with the IRS to resolve your dispute without the need for litigation. A settlement can be a mutually agreeable resolution that avoids the uncertainty of a court decision.

Don’t Take on the IRS Alone — Work with a Skilled Tax Lawyer

Suing the IRS is a momentous decision that calls for careful consideration and preparation. While it’s possible to take legal action against this powerful government agency, it’s important to first exhaust all administrative remedies and seek the guidance of a skilled tax attorney.

By understanding your rights and the legal options you have available, you can make informed decisions and demand fair treatment within the tax system more effectively.

If you find yourself overwhelmed and in need of professional assistance, the experienced legal team at Tax Relief Counsel is here to help. We’re focused on resolving tax disputes and can offer the guidance and support you need to stand up to the tax authorities. Contact us today to schedule a consultation and learn more about how to proceed.