Table of Contents

Few financial situations are as vexing as owing back taxes to the IRS. If you’re behind on payments, you might find yourself lying awake at night wondering, “How much can the IRS actually take from my paycheck?”

Wage garnishment is a powerful tool the IRS can use to collect unpaid taxes. This process allows them to legally deduct a portion of your wages directly from your paycheck until your tax liability is settled.

While the idea of wage garnishment is understandably stressful, understanding the process, potential limitations on what the IRS can garnish, and your rights as a taxpayer can alleviate some of the anxiety and help you regain control.

This guide will walk you through the ins and outs of IRS wage garnishment, explaining how those dreaded amounts are calculated, what factors might reduce or increase what’s taken, and what you can do to avoid getting to this point in the first place.

Who Can Have Their Wages Garnished by the IRS?

Wage garnishment isn’t something that happens overnight or without warning. The IRS can’t simply decide to start taking money from your paycheck because you owe them money. The agency must follow specific procedures before it can begin garnishing your wages.

Generally, wage garnishment occurs after the IRS has taken the following steps to collect a tax debt:

- Imposing a tax lien: The IRS will start by filing a federal tax lien, a public document that attaches to your assets, including property.

- Issuing a levy: Next, the agency will issue a levy, which authorizes the legal seizure of assets (a bank account levy, for example).

- Sending a CP504 notice: Before moving forward with garnishment, the IRS is required to send you a Notice of Intent to Levy at least 30 days in advance.

The Notice of Intent to Levy is a final warning outlining your rights and options to appeal or request a payment arrangement.

Just whose wages are subject to this process? Here are some of the individuals who are commonly at risk of wage garnishment:

Employees (W-2 Income)

This is the most straightforward scenario, as employers may be legally obligated to withhold and send the IRS a portion of the employee’s pay.

Independent Contractors (1099 Income)

The IRS can garnish the income of self-employed individuals, though it’s often more logistically challenging without an employer to work through.

Retirees

Tax authorities can also garnish certain retirement income streams, such as 401(k)s and some types of pensions, depending on specific rules and regulations.

How Does the IRS Determine Wage Garnishment Amounts?

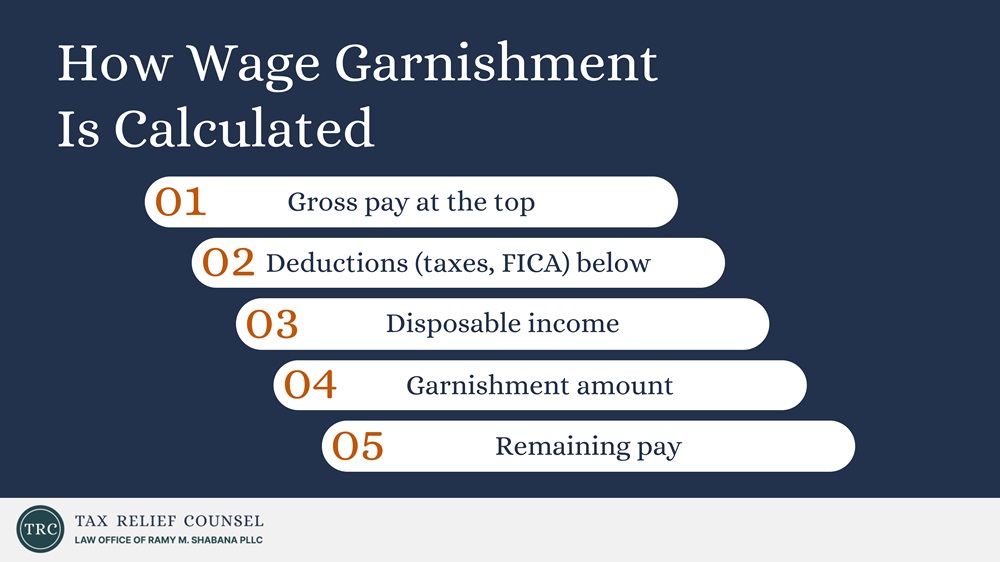

When determining how much to garnish from your paycheck, IRS officials don’t simply choose an arbitrary figure — they use a formula based on your earnings and allowable deductions. A crucial element in this calculation is your disposable income, which is the amount of money you have left over after essential expenses.

This is where it can get tricky. The IRS uses its own criteria for figuring out what’s “essential.” They offer two primary standards:

Standard Deduction

The IRS applies a standardized deduction amount based on factors like your filing status, the number of dependents you have, and the standard deduction allowed on your tax return for the year. They’ll pay this sum back to you after levying the amount you owe.

Financial Hardship Deduction

If the standard deduction would leave you unable to cover basic living expenses, you can potentially qualify for a larger deduction based on your specific situation. This arrangement is usually only available in situations of financial hardship.

Explore Your Options for Reducing Your Garnishment Burden

Demonstrating financial hardship in the face of wage garnishment can be challenging. Tax Relief Counsel can help you understand your rights and determine whether you qualify for a reduced garnishment or temporary relief.

Call Me Personally

The Standard Garnishment Formula: What’s Left After the IRS Takes Its Share?

To help you better understand how the IRS goes about garnishing wages, an example is in order.

Let’s assume you get paid monthly, and your gross pay (before taxes) is $2,500. Here’s what your deduction schedule might look like:

- Mandatory deductions (federal and state taxes, FICA, etc.): $800

- Disposable income: $2,500 (gross income) – $800 (deductions) = $1,700

The IRS can typically garnish up to 25% of your disposable income. In this example, $1,700 x 0.25 = $425. That means you’d keep about $1,275 after garnishment.

Now, let’s adapt the example for a weekly pay scenario. Assume that your gross weekly pay is $750, and the IRS’s mandatory deduction is $200. Here’s what you could expect:

- Weekly disposable income: $750 – $200 = $550

- Garnishment of 25%: $550 x 0.25 = $137.50 (approx.)

- Remaining weekly pay: $550 – $137.50 = $412.50

As you can see, you’ll still receive a portion of your earnings to cover essential living expenses, even after the IRS takes its cut.

Keep in mind that these examples use illustrative amounts only. The IRS will determine the actual garnishment amount based on your unique financial situation and the amount of back taxes you owe. It’s crucial to seek professional guidance to understand how the rules apply to you.

Can the IRS Show Leniency?

If the standard garnishment formula would leave you unable to meet your basic needs — such as rent or mortgage payments, food, utilities, or necessary medical expenses — you might qualify for a reduced garnishment through the IRS’s financial hardship program.

To qualify, you must demonstrate your financial constraints through documentation, providing evidence of your income, expenses, household size, and other relevant financial obligations.

Approval for a hardship reduction isn’t guaranteed. The IRS will carefully review your circumstances to decide whether your situation genuinely warrants a smaller garnishment or temporary relief.

What the IRS Can’t Take from Your Paycheck

It’s important to understand that not all income is subject to IRS wage garnishment. While the agency has broad authority to collect unpaid taxes, there are legal protections in place to ensure that taxpayers can still afford basic needs.

Here’s a general overview of what the IRS can’t touch:

Child Support and Alimony

If you’re legally obligated to make child support or alimony payments, the IRS can’t garnish these funds. Those funds are designated for your dependents or former spouse and are generally protected from seizure.

Social Security Benefits

For the most part, Social Security benefits are insulated from wage garnishment. However, exceptions to this rule may exist when there are unpaid federal taxes, in which case the IRS can claim up to 15% of each payment.

Disability Benefits

Similar to Social Security, the IRS can garnish up to 15% of your disability benefits (including VA benefits) until your tax obligations are satisfied. Exceptions for certain debts might apply.

Because state laws often provide additional protections for debtors (for example, exempting a higher percentage of wages from garnishment than federal law requires), it’s crucial to consult a tax professional in your area to understand all available options.

Stopping Wage Garnishment Before It Starts: Understanding Your Rights and Options

Ideally, you’ll want to resolve your tax debt before it escalates to wage garnishment. Taking proactive steps can help you avoid this stressful situation altogether.

Here are some options for addressing your outstanding tax debt:

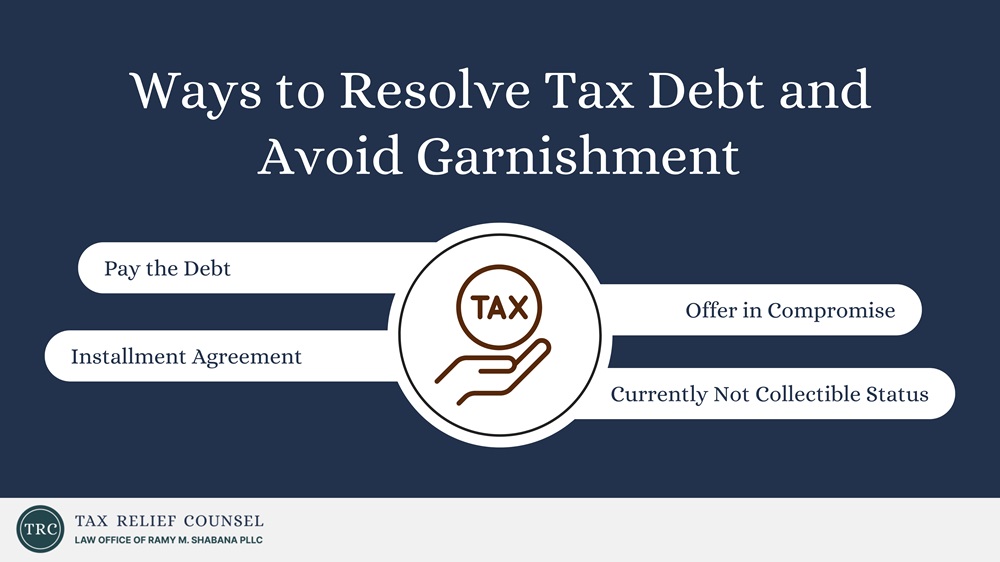

Pay Your Tax Debt in Full

If at all possible, set aside some money to pay off your back taxes completely. This is the most straightforward option, and it will keep the IRS from pursuing further collection actions.

Negotiate an Installment Agreement

An installment agreement will allow you to make monthly payments over an extended period to settle your tax liability. Setting up a payment plan demonstrates your commitment to resolving your debt and can prevent further enforcement actions.

Submit an Offer in Compromise (OIC)

In certain situations, you might be eligible to settle your tax liability for a lower amount than what you originally owed. Offers in compromise are typically reserved for cases of significant financial hardship where paying the full amount is deemed impossible.

Determine Whether You Qualify for CNC Status

In cases of extreme financial hardship where you have little to no income or assets, the IRS might temporarily classify your account as “currently not collectible” (CNC). While CNC status doesn’t erase your debt, it halts collection efforts, including wage garnishment, while you get back on your feet financially.

Take Action to Face the Threat of Wage Garnishment

Wage garnishment is a serious consequence of failing to pay your taxes. Understanding how it works, the potential limits on the amount garnished, and your options for seeking relief can help you get through this difficult situation with greater knowledge and less stress.

Don’t wait for the IRS to come knocking. Reach out to seasoned tax attorney Ramy Shabana today to schedule a consultation. He can go over your options for resolving your tax issues and help you protect your income and regain your peace of mind.

Call Me Personally