Table of Contents

If you’ve ever faced a hefty tax bill with the IRS, you know how stressful it can be to owe money to the government.

Fortunately, the IRS offers various payment solutions to help taxpayers manage their tax debts. One of the more accessible options is the streamlined installment agreement. If you’re considering this route, having an experienced installment agreement lawyer on your side will be crucial for ensuring that you get the most favorable terms.

Here’s what to know about IRS streamlined installment agreements, how they work, and how to qualify for one.

What Is a Streamlined Installment Agreement?

A streamlined installment agreement is a payment plan the IRS offers that allows taxpayers to pay off their tax debt in manageable monthly payments over a set period.

This type of agreement is designed for individuals who owe a lower amount of tax liability (less than $50,000) and can repay it within a specified time frame without the need for extensive financial disclosure or detailed collection information statements.

The particulars of these agreements are outlined in IRM 5.14.5.2 Streamlined Installment Agreements.

How Does the Agreement Work?

Under a streamlined installment agreement, the IRS allows an eligible taxpayer to pay back their assessed tax burden over a period of up to 72 months or before the collection statute expiration date, whichever comes first.

One key benefit of such an agreement is that the taxpayer doesn’t need to provide detailed financial information, such as bank accounts, assets, and alternative income streams. Instead, they can qualify based on the amount of their tax debt alone.

Eligibility for a Streamlined Installment Agreement

Not everyone automatically qualifies for a streamlined installment agreement. To be eligible for this type of payment plan, you must meet the following conditions:

- You must owe $50,000 or less in assessed taxes (penalties and interest included).

- You must pay off your debt within 72 months or before the collection statute expiration date.

- All of your required tax returns must be filed and up to date.

- You must be current on any federal tax deposits or estimated tax payments if you’re self-employed.

Provided you meet these requirements, applying for a streamlined agreement could make it easier to pay down your debt with the IRS.

Types of Streamlined Installment Agreements

There are two primary ways to set up a streamlined installment agreement:

Direct Debit Installment Agreement (DDIA)

With a Direct Debit Installment Agreement (DDIA), your monthly payment is automatically withdrawn from your checking account or bank account. This is generally the optimal method, as it ensures timely payments and helps you avoid defaulting on your agreement.

Payroll Deduction Agreement

This option allows you to have your monthly payment deducted directly from your paycheck. It’s less common but can be a helpful alternative for those who prefer payroll deductions to keep up with their monthly payments.

Benefits of a Streamlined Installment Agreement

Taking advantage of a streamlined installment agreement can present several key benefits, including:

- No need for detailed financial disclosure: A streamlined payment plan doesn’t require extensive information about your assets or financial status.

- Automatic acceptance: As long as you meet the criteria, your request will likely be approved.

- No tax lien: Generally, the IRS won’t file a federal tax lien as long as you owe less than $50,000 and enter into the agreement before any collection action is taken.

These are just a few of the many reasons to consider seeking a streamlined installment agreement if you’re having difficulty paying your tax debts to the IRS.

Minimum Monthly Payment Requirements

When you enter a streamlined installment agreement, the IRS sets a minimum monthly payment based on your total debt and the time you have to repay it. The agency typically calculates this payment by dividing the total balance by 72 months. However, it may accept lower payments if you can prove financial hardship.

Streamlined Installment Agreement vs. Guaranteed Installment Agreement

You might be wondering how this agreement compares to a guaranteed installment agreement. The key difference lies in the eligibility criteria.

A guaranteed installment agreement is available for taxpayers who owe $10,000 or less, while the streamlined option is for those who owe up to $50,000. Both options allow for monthly payments, but the streamlined version offers a higher debt threshold and doesn’t require as many formal guarantees.

What If You Owe More Than $50,000?

If your tax debt exceeds $50,000, you won’t qualify for a streamlined installment agreement, though you can still apply for a standard installment agreement. In this case, you’ll need to submit a detailed financial statement and possibly negotiate a partial payment installment agreement.

Get Skilled Legal Help Resolving Your Tax Debt

If you’re feeling the pressure of mounting tax debt, you don’t have to face the IRS alone. Ramy Shabana, experienced tax attorney and founder of Tax Relief Counsel, is here to help you find the best solution for your situation. Reach out today for a free consultation.

Call Me Personally

How to Apply for a Streamlined Installment Agreement

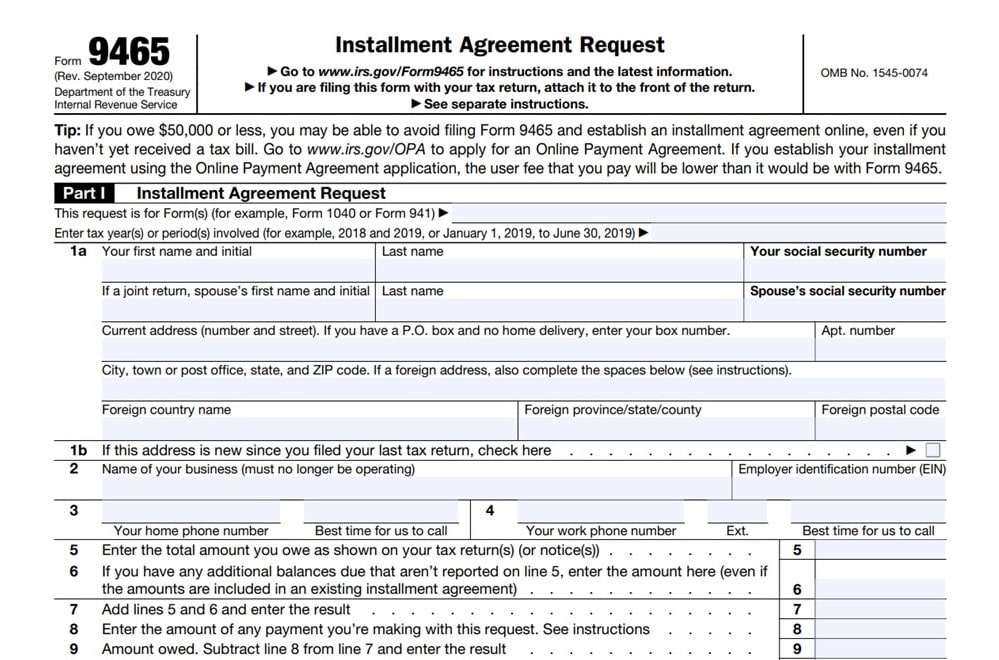

Applying for this type of agreement is relatively straightforward. You can either apply online via the IRS’s online payment plan portal, download and submit Form 9465, or contact the IRS directly. The agency also provides a separate PDF file with detailed instructions.

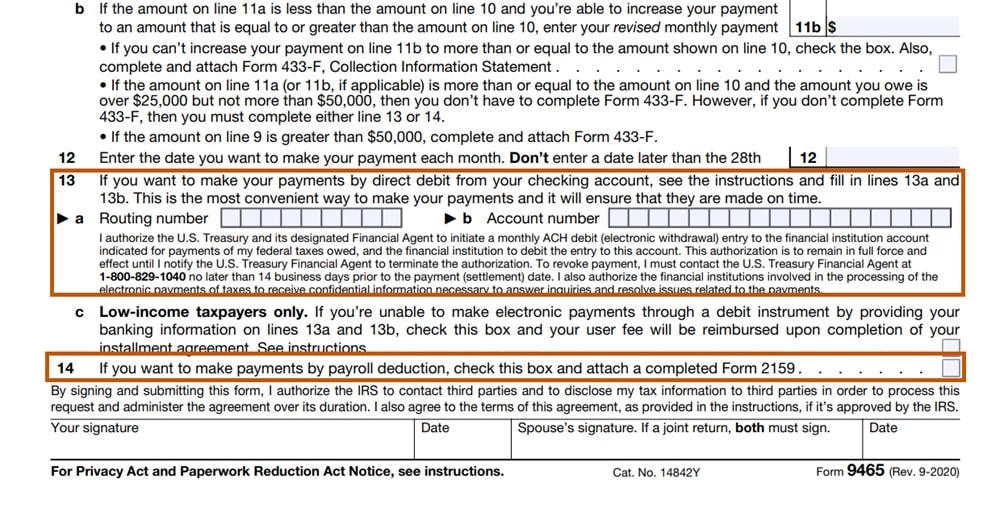

If you opt to apply online, you’ll be asked to create a DDIA or select another payment method, such as a money order or payroll deduction. If you’d prefer to complete the PDF version, you’ll need to fill in lines 13a and 13b to authorize direct debit.

To request a payroll deduction agreement, you’ll need to check the box on line 14 of Form 9465 and also file Form 2159.

Setup Fees

When setting up a streamlined installment agreement, you’ll usually be required to pay a setup fee unless you qualify for a fee waiver due to low income. The setup fee will be reduced if you select direct debit for your payments.

Penalties and Interest on Streamlined Installment Agreements

While entering this type of agreement can help you avoid being subjected to aggressive IRS collection tactics, it’s important to note that penalties and interest will continue to accrue on your unpaid balance. Making regular monthly payments will prevent further penalties from being applied.

What Happens If You Miss a Payment?

Missing a payment under a streamlined installment agreement can lead to significant consequences, including defaulting on the agreement and triggering collection actions like a tax lien or wage garnishment. To avoid this, it’s critical to ensure that you’re making your payments on time, whether through direct debit or another reliable method.

Streamlined Installment Agreement and Tax Liens

One of the biggest fears for many taxpayers in debt is the possibility of a federal tax lien. Fortunately, the IRS doesn’t typically file a tax lien for those who qualify and successfully enroll in a streamlined installment agreement, provided the debt is paid off according to the outlined terms.

How to Modify or Terminate a Streamlined Installment Agreement

If you find yourself unable to meet the terms of your agreement due to changes in your financial situation, you can request a modification from the IRS. In certain cases, such as if you’re facing extreme financial hardship, the IRS may allow a reduction in your monthly payment or place your account in “currently not collectible” status.

Take Control of Your Tax Debt with Tax Relief Counsel

Tax debt can feel like a crushing burden, which is why the IRS offers helpful solutions like streamlined installment agreements to help taxpayers get back on track. By spreading your tax liability into affordable monthly payments, you can regain control of your finances without the headache of IRS collection efforts.

If you owe $50,000 or less and meet the eligibility requirements, a streamlined agreement could be the ideal solution for paying off your debt without the need to provide detailed financial disclosures.

If you’re struggling with tax debt, your best option is to reach out to a qualified tax professional to discuss whether a streamlined installment agreement might be right for you. Tax Relief Counsel is dedicated to providing reliable legal guidance and support to help individuals and businesses resolve their tax debt and achieve lasting financial security.

Contact us today to schedule a free consultation. We’ll help you manage your IRS obligations and find the best path forward.