Table of Contents

Taxes are never enjoyable, especially when you’re on the receiving end of a notice from the IRS.

A Notice of Deficiency Waiver (officially known as IRS Form 5564) leaves many taxpayers bewildered and unsure of how to proceed. Don’t panic: We’ll break down what a Notice of Deficiency is, why the IRS might send one, and most importantly, how you should respond.

If you have questions about tax forms or are facing an IRS audit, contact Tax Relief Counsel to speak to an experienced tax attorney in Washington, D.C.

What Does “Notice of Deficiency” Mean?

The Notice of Deficiency Waiver is often attached to a more significant document: the Notice of Deficiency (Notice CP3219A). This notice, sometimes referred to as a statutory notice, deficiency letter, statutory notice of deficiency, or the dreaded 90-day letter, should come by certified mail. It is the IRS’s way of officially informing you that it has found a discrepancy in your tax return.

Here’s what you’ll find outlined in a Notice of Deficiency:

- Summary of proposed changes: How much the IRS believes you underpaid, along with any interest and other fees.

- Changes to your tax return: Changes to specific lines in your tax return, such as income, deductions, or credits.

- Explanation of changes: The information that the IRS is basing these proposed changes on, along with the sources of this information.

Once the IRS sends a Notice of Deficiency, a 90-day clock starts ticking. Before this deadline arrives, you have the right to challenge the IRS’s findings in Tax Court.

However, if you let 90 days pass without taking action, the IRS may conclude that you owe the proposed amount and continue to assess interest and other penalties. If you don’t pay, it could then impose a tax lien, seize certain assets, or garnish your wages until this debt is paid.

Why Did I Receive an IRS Notice of Deficiency?

The IRS doesn’t issue these notices arbitrarily. They typically result from a mismatch between the information reported on your tax returns and the information the IRS receives from other sources, such as employers and banks.

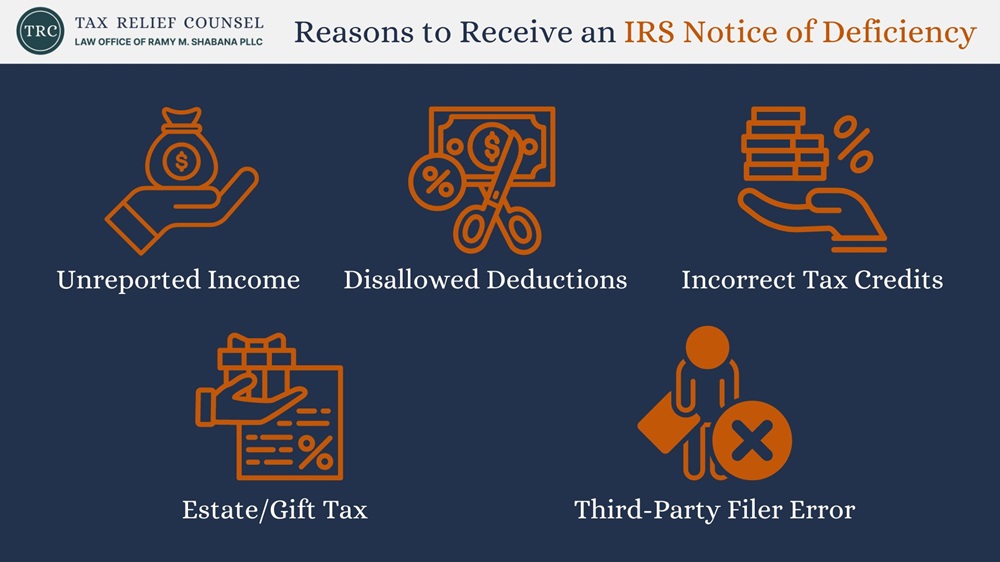

Here are some of the most common triggers for a Notice of Deficiency:

- Unreported income: Information from a third party indicating that you received income that wasn’t included on your return, such as a W-2 or 1099 form.

- Disallowed deductions: Tax deductions that you claimed without sufficient documentation or that the IRS believes you weren’t eligible for.

- Incorrect tax credits: Tax credits you claimed that the IRS believes you don’t qualify for.

- Estate tax, gift tax, or excise tax issues: Errors in the reporting or calculation of these less common taxes.

- Errors from third-party filers: Incorrect information from a financial institution or employer that conflicts with your tax return.

Mistakes happen! Sometimes, employers and financial institutions submit incorrect information to the IRS. But even if it wasn’t your error, it’s your responsibility to resolve it.

Notice of Deficiency Waiver (IRS Form 5564): Should You Sign It?

Near the end of Notice CP3219A, you should see Form 5564, the Notice of Deficiency Waiver. By completing this form, a taxpayer notifies the IRS that they acknowledge the proposed changes to their return. They give up their right to dispute the additional tax assessment and agree to pay it.

Reasons to Sign a Notice of Deficiency Waiver

Since signing Form 5564 is irrevocable, it’s important to consider the pros and cons of completing this waiver. Here are a few reasons to sign it.

You’re Ready to Resolve the Problem

Suppose that you’ve reviewed the Notice of Deficiency and agree with the IRS’s findings. Perhaps you forgot to include interest income from one of your accounts or made another mistake. In this case, signing the waiver may be the right option. This can allow you to pay the penalty and put the matter behind you without delay.

You Want to Avoid Tax Court

Tax Court is a formal legal process that can be time-consuming, stressful, and expensive. If you’d rather avoid litigation and the associated legal fees, signing the waiver could be tempting. Before you do, carefully consider the financial benefits you’ll receive if you successfully contest the Notice of Deficiency.

You’ve Already Agreed on a Settlement

You may have already been in contact with the IRS and agreed on a settlement amount or payment plan. Signing a Notice of Deficiency Waiver might be a requirement to finalize that agreement.

Reasons Not to Sign a Notice of Deficiency Waiver

These are some good reasons not to sign the waiver.

You Disagree with the IRS

This is the most critical reason not to sign. If you believe the IRS is wrong about the proposed changes and you have documentation to support your case, you can try to resolve the issue without going to court. Signing the waiver means that you give up your right to challenge the IRS’s assessment, so this is not the best option if you fundamentally disagree with it.

You Need More Time

The 90-day deadline for responding to a Notice of Deficiency is nonnegotiable. If you need additional time to gather documentation, speak to a tax professional, or explore your options, do not sign the waiver.

Instead, you can file a petition with the Tax Court to pause that 90-day clock and prevent the IRS from immediately assessing additional taxes. By filing a petition, you create the opportunity to build a case for formally contesting the IRS proposal.

Want to Know If Signing the Waiver Is the Right Move?

Don’t take chances on your taxes. Contact Tax Relief Counsel today for a free consultation.

Call Me Personally

How to Respond to a Notice of Deficiency and Waiver Request: 3 Options

Receiving an IRS notice, especially one as serious as a Notice of Deficiency, can be intimidating. But you should know that you have options. Here are three ways to respond to an IRS Notice of Deficiency:

Option 1: Submit Payment

After reviewing the notice and consulting with a tax professional, you might decide that you understand and agree with the IRS’s proposed changes. In that case, the right option may be to complete Form 5564 and pay the deficiency.

You can enclose your payment when you send the Notice of Deficiency Waiver, or you can work with the IRS to set up a payment plan. To apply for a payment plan, include Form 9465 (Installment Agreement Request) when you send in the waiver.

Option 2: Respond with More Information

You can dispute the proposed changes by responding to the Notice of Deficiency. This is a good option if you believe the IRS made an error or if you have new and compelling evidence that wasn’t considered during the initial audit,

This dispute might involve writing a letter explaining your situation and providing supporting documentation. However, if you do not have strong evidence that clearly demonstrates the IRS’s error, it is not likely to be successful.

Option 3: File a Petition with the Tax Court

If you disagree with the IRS’s proposed adjustments and want to formally challenge its findings, filing a petition with the Tax Court is the next step. This is a specialized court designed to handle disputes between taxpayers and the IRS. It’s highly advisable to have legal representation from an experienced tax attorney if you choose this path.

How a Tax Attorney Can Help

An IRS Notice of Deficiency can have serious financial implications. If you want to know whether you have a good case for disputing the notice, contact a tax attorney at Tax Relief Counsel. We can help you understand the IRS’s decision and advocate for your best interests.

Here’s what we can do for you.

Review Your Case

We will start with a thorough case review. This involves examining the IRS’s proposed changes, analyzing your original tax return, and assessing any supporting documentation you have.

Explain Your Rights

After we have reviewed your case, we will help you determine the best course of action. This may be accepting the changes, providing additional information to the IRS, or fighting the proposed changes in Tax Court. We can explain the potential outcome of each option, along with the consequences of signing (or not signing) a Notice of Deficiency Waiver.

Negotiate with the IRS

Negotiating with the IRS could be the next step. This might include providing clarifying information, presenting legal arguments to support your position, or working toward a favorable settlement. Whatever the outcome, you can count on your tax attorney to negotiate in your best interests.

Represent You in Tax Court

If a resolution cannot be reached through negotiation, our experienced tax attorney can represent you in Tax Court. This involves filing the necessary paperwork, presenting evidence, and arguing your case before a judge.

Want Help Responding to a Notice of Deficiency?

A Notice of Deficiency is never welcome news, but you can make it through this challenge if you know your rights and options. At Tax Relief Counsel, we can help you understand your notice, explore potential solutions, and advocate for your best interests every step of the way.

Ignoring any request from the IRS can lead to costly penalties and further consequences. Don’t let uncertainty lead to bigger tax problems. Contact us today for a free and confidential consultation and take the first step toward a resolution.

Disclaimer: This blog post is for informational purposes only and should not be considered legal or tax advice. Consult with a qualified tax professional for guidance on your specific circumstances.