Table of Contents

Facing an IRS audit can be a nerve-racking experience, especially when you’re left in the dark about how long the process might take. Understanding the potential duration of an audit is essential for managing expectations and reducing stress.

This guide will walk you through the general timeline of an IRS audit, highlight key factors that can impact its duration, and provide valuable tips to help potentially streamline the process.

Can You Reduce the Chances of an IRS Audit?

Before we delve into the timeline itself, let’s address a common concern: is there any way to minimize the risk of getting audited in the first place? While no one can completely eliminate the possibility, certain proactive measures can significantly reduce the likelihood of attracting unwanted attention from the IRS.

File Accurate Returns

Accuracy is paramount when it comes to your tax filings. Double-check all information, use tax software for calculations, and if you have a complex tax situation, consider hiring a qualified tax professional.

Maintain Meticulous Records

Thorough record-keeping is essential for supporting deductions, credits, and other financial claims made on your return. If the IRS has questions, you’ll want to have backup documentation readily available.

Be Mindful of Audit Triggers

The IRS uses various factors to select returns for audit. While some are random, being aware of common “red flags” can help you minimize potential risks. These flags might include high income, unusually large deductions, home-based businesses, and more.

Address Tax Liabilities Promptly

Delaying payment or ignoring tax liabilities can increase your chances of future audits. If you owe taxes, exploring options like payment plans or an offer in Compromise demonstrates your commitment to resolving the issue, potentially reducing the need for a full-blown audit.

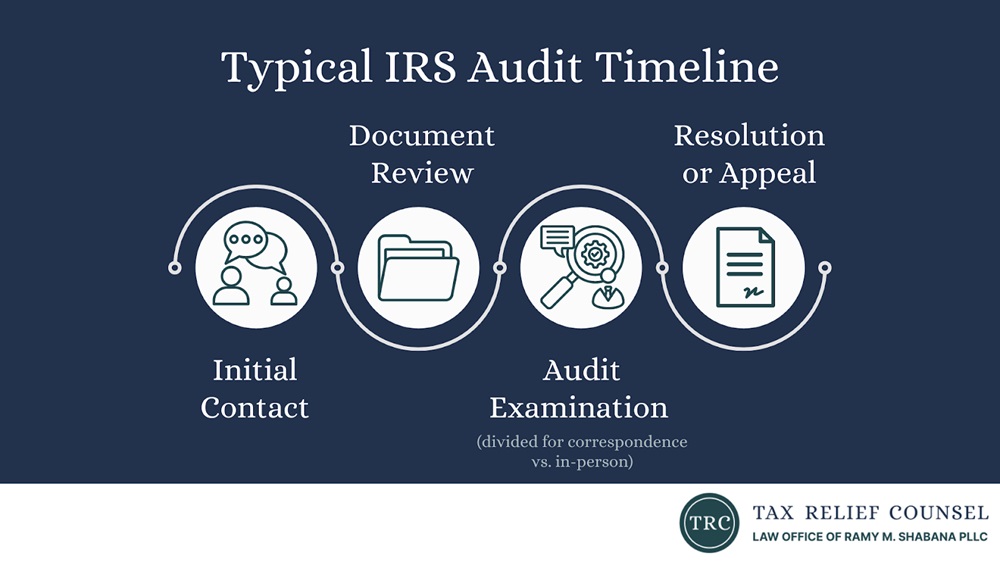

Stages of an IRS Audit and Their Typical Timeframes

Now that we’ve covered some preventive measures, let’s dive into the heart of the matter: what actually happens during an IRS audit, and how long does each step typically last? Keep in mind that the following is a general timeline, and the specific duration for your case may vary.

Stage 1: IRS Initiates Contact and Information Request

The IRS typically begins an audit by notifying you either through mail (via certified letter) or by phone. This initial contact will outline the reason for the audit, the tax year(s) under review, and the specific documents or information they require.

It’s crucial to respond to the IRS by the stated deadline and gather all necessary documentation. This stage usually takes a few weeks, depending on the promptness of your response.

Stage 2: Reviewing and Responding to the IRS

Once the IRS receives your initial response and documentation, they will begin the review process. This stage involves examining your provided information and potentially conducting further research. You might be asked for additional documents or clarifications.

This phase can take weeks to several months, depending on the complexity of your case and the efficiency of your communication with the IRS.

Concerned Your Audit Might Drag On? We Can Help You Navigate the Process

Each audit is unique, and many factors influence the timeline. Having a tax professional by your side can help ensure efficient communication with the IRS, minimize potential delays, and work toward a smoother, potentially faster resolution.

Call Me Personally

Stage 3: The Audit Examination

If the IRS requires further scrutiny of your financial records, they will schedule an audit examination. This examination can be conducted through two primary methods:

- Correspondence audit (mail): The IRS communicates with you through mail — often requesting additional documentation or clarifications.

- Office or field audit (in-person): You will meet with an IRS agent at an IRS office or your business location.

Correspondence audits are typically faster, often resolved within weeks or a few months, whereas field audits potentially span months or longer due to their extensive nature.

Stage 4: Post-Audit: Resolution or Appeal

After the audit examination, the IRS will either accept your return as filed, propose adjustments that you agree to, or issue a formal notice of deficiency.

If the IRS accepts your return or if you reach an agreement on adjustments, the audit concludes, and you’ll receive written confirmation within weeks to a few months.

If the IRS issues a notice of deficiency, you have the right to appeal the findings through the IRS appeals process or even take the case to tax court. These scenarios can significantly extend the timeline, potentially taking several more months or even years.

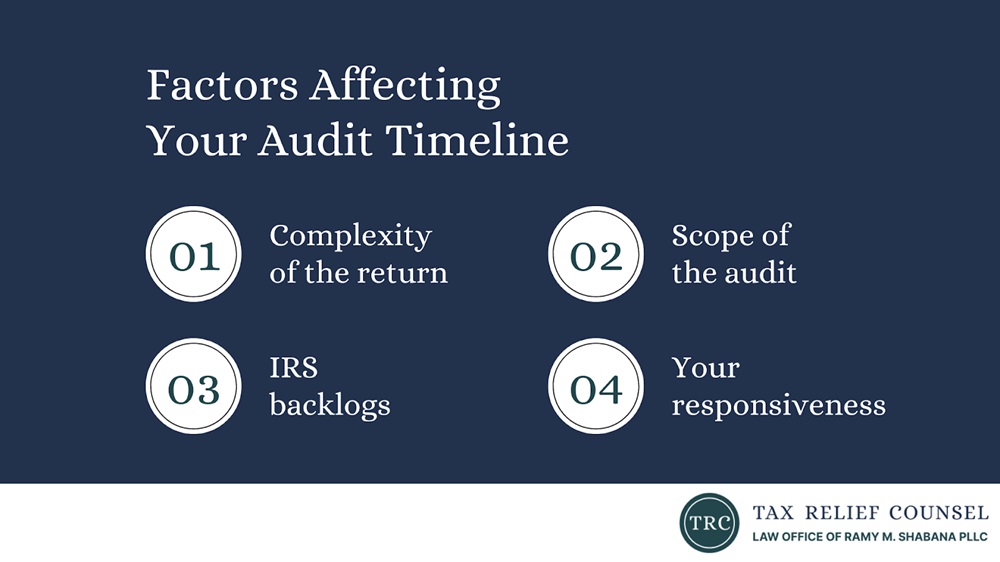

What Can Impact the Timeline of Your IRS Audit?

Several factors influence how long your IRS audit might take:

The Complexity of Your Tax Return

More complex tax situations — involving business income, multiple investments, foreign accounts, or complicated deductions — generally translate to longer audits. The IRS might require more time to examine extensive documentation and financial records.

The Scope of the IRS Audit

The scope of your audit also plays a significant role in the timeline. The IRS might focus on a specific item on your return (like a large charitable contribution deduction) or choose to examine multiple years of your tax filings, which can extend the process.

The Dreaded Backlog: It’s Not Just You!

Like any government agency, the IRS faces fluctuating staffing levels and workloads, potentially creating backlogs that can delay audits. Unfortunately, these delays are beyond your control, but staying organized and responsive can help mitigate their impact.

Your Responsiveness

The more organized, responsive, and communicative you are with the IRS throughout the audit, the smoother and potentially faster it may go. Promptly providing requested information and meeting deadlines can help expedite the process.

Whether You Have Professional Assistance

Hiring an experienced tax professional — an Enrolled Agent (EA), Certified Public Accountant (CPA), or tax attorney — to represent you can be a wise investment. They understand the intricacies of tax law and IRS procedures, often navigating the system more efficiently than someone representing themselves.

Need Help Navigating Your Audit Journey? We’re Here for You

While facing an IRS audit is rarely a welcome experience, understanding the process and your rights can alleviate some of the anxiety. By staying organized, communicating proactively, and seeking professional guidance when needed, you can approach this situation strategically and work toward a timely resolution.

Don’t go through this alone! Schedule a free consultation with our tax professional, Ramy Shabana, today, and let us help you navigate the complexities of your IRS audit with confidence.