Table of Contents

If you’ve received a CP2000 notice from the IRS, you might feel a wave of anxiety. This notice indicates that the IRS has identified potential discrepancies between the income information reported on your tax return and what your employers or financial institutions have reported.

While a CP2000 isn’t an audit, it does require your prompt attention to avoid potential additional taxes and penalties. Should you handle this notice yourself or hire a tax lawyer?

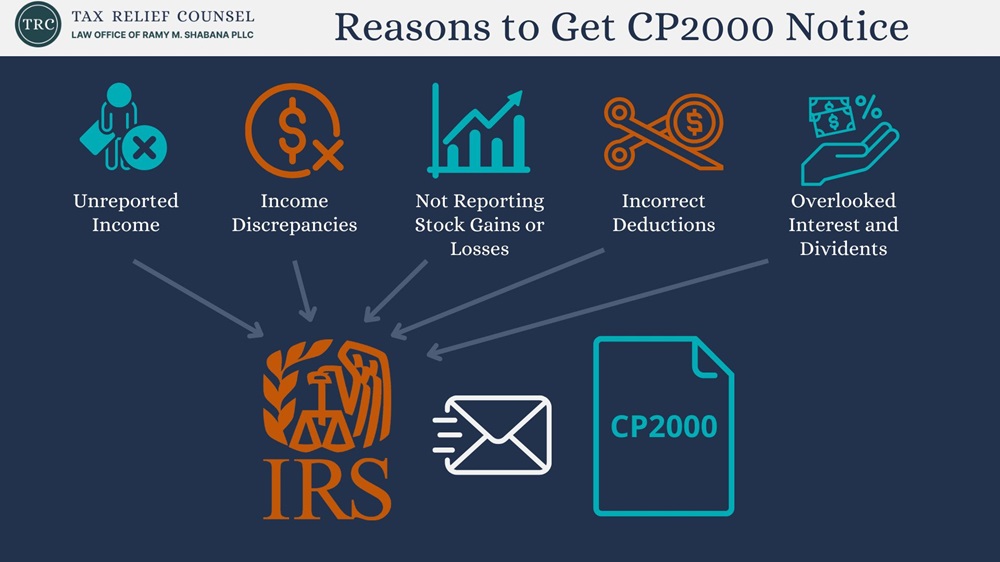

Why Did I Receive a CP2000 Notice?

The IRS sends a CP2000 notice when its automated system flags discrepancies in reported income. This notice outlines the proposed amount of additional tax you may owe, including interest and possible penalties.

For example, if you failed to report income from a side gig or investment, the IRS will propose changes through a CP2000 notice. This helps officials determine whether you owe more taxes or there’s been a simple oversight.

Reviewing the Notice

Before responding to your notice, take the time to analyze it. Carefully review the entire document to ensure that the income and deductions mentioned align with what you’ve reported.

It’s also important to understand the information reported by other payers, such as banks or employers, and compare it to your original tax return. Identify any missing income or incorrect deductions that may have led to the underreporter inquiry.

Accurate documentation is vital when addressing a CP2000 notice. You’ll need to gather supporting documentation that verifies your claims, such as W-2s, 1099 forms, and other income information. This will help you present a clear case if you disagree with the proposed changes.

How to Respond to a CP2000 Notice

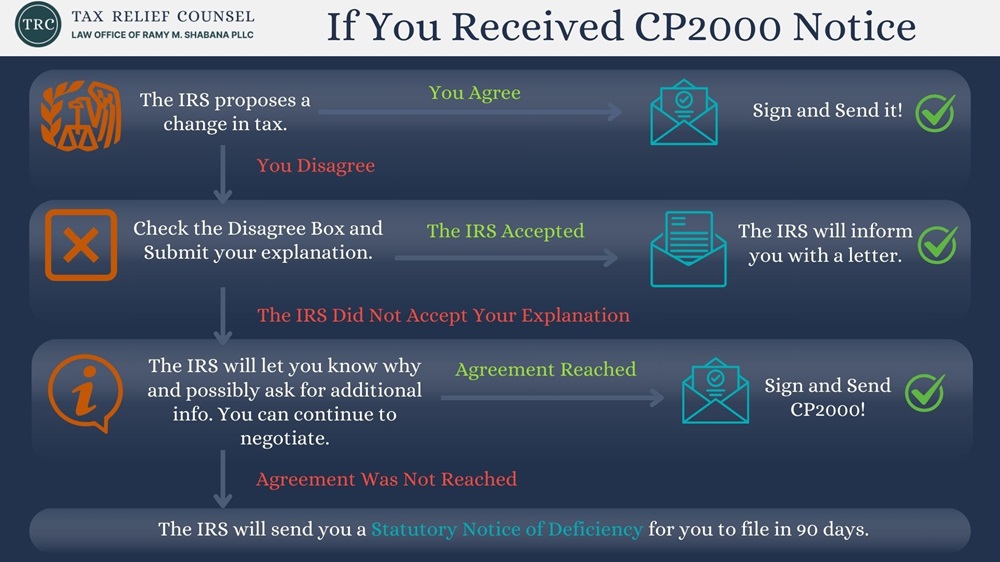

You can use the response form included with your CP2000 notice to formally address the proposed changes. You can either agree, partially agree, or disagree with their findings. Make sure your response includes all necessary supporting documentation, then use the enclosed envelope to mail it.

Alternatively, you can reply online using the IRS document uploading tool, by fax at the location listed on the left side of the notice, or by mail at the address on the top left corner of the first page.

The IRS will expect a timely response, so don’t delay.

Agreeing with the Notice

If you agree with the proposed amount, all you have to do is sign the response form and return it to the IRS by the due date. Make it a point to arrange a payment plan or pay the amount in full to avoid further interest accrual.

Disagreeing with the Notice

If you disagree with any part of the notice, explain why in detail and attach your supporting documentation to back up your claim. Use an online fax service or mail your response to the IRS’s fax number or address provided on the notice. Always keep copies of everything you send for your records.

Filing an Amended Return

In some cases, the most straightforward approach may be to file an amended return (Form 1040-X) if you notice errors in your original filing. By doing so, you can correct inaccuracies and potentially reduce your additional tax obligations.

Involving a Tax Professional

Dealing with a CP2000 notice can be stressful. A qualified tax professional can offer valuable assistance by analyzing your circumstances, reviewing your tax return, and determining the best course of action. Their knowledge and insight can help you respond properly and avoid unnecessary penalties.

Need Help with an IRS CP2000 Notice?

Don’t deal with the IRS alone. Contact the trusted tax professionals at Tax Relief Counsel today for reliable assistance.

Call Me Personally

Consequences of Ignoring a CP2000 Notice

Ignoring your notice won’t make it go away. Failure to respond by the due date can lead to a statutory notice of deficiency, potentially escalating to an IRS audit or other enforcement actions. Additionally, interest and penalties will continue to accumulate on any unpaid balances.

Avoiding Future CP2000 Notices

To prevent any further issues, always double-check your tax returns before filing. Verify that all income reported by financial institutions, employers, and banks matches what you’ve declared. Accurate reporting can save you the headache of future underreporter inquiries.

Common Mistakes to Avoid

Some of the most common mistakes taxpayers make when handling CP2000 notices include:

- Overlooking income from side gigs or investments.

- Not updating their payment information or contact details with the IRS.

- Rushing through tax forms without verifying details.

It’s essential to submit accurate, verifiable information to avoid increased scrutiny and potential penalties.

Tips for Responding Effectively

The following tips will help you prepare a response that adequately addresses the IRS’s concerns and any outstanding tax obligations you may have:

- Gather and organize all relevant documents.

- Respond well before the due date to give yourself plenty of time.

- Use certified mail to ensure that the IRS receives your response.

- Seek assistance from a tax professional if you’re unsure how to proceed.

An experienced tax lawyer can help you understand what the IRS is looking for and respond correctly and in a timely fashion.

What Happens After You Respond?

Once you’ve submitted your response form, IRS agents will review your case. This process may take several weeks. If the agency’s officials accept your response, you’ll receive a letter confirming the resolution. If they disagree, you may need to provide additional information or take further action.

Get a Skilled Tax Attorney on Your Side

Receiving an IRS CP2000 notice can be nerve-racking, but by understanding the process and responding promptly, you can resolve the situation effectively. Taking proactive steps and staying informed will help you handle any discrepancies confidently and with minimal impact on your financial health.

The professionals at Tax Relief Counsel focus on guiding individuals through complex tax issues, including responding to IRS notices. If you’re uncertain how to proceed or need tailored guidance, our experienced team can help you navigate your response and explore all available options.

Contact us today to request a free consultation and take the first step toward addressing your IRS CP2000 notice.