Table of Contents

Working with IRS forms can feel like deciphering a foreign language. Among the many forms taxpayers might encounter, Form 433-D stands out as a critical tool for those who need to set up a payment plan with the IRS.

What exactly is Form 433-D, and how can it help you manage your tax debt? This helpful guide will tell you everything you need to know about this important form, including its purpose and how to complete it accurately.

What Is Form 433-D?

Form 433-D is a form the IRS uses to set up payment plans known as Direct Debit Installment Agreements for taxpayers who owe federal income tax. These plans allow you to make monthly payments directly from your bank account, ensuring timely payments and avoiding potential penalties.

Opting for a Direct Debit Installment Agreement can greatly simplify the payment process. By authorizing the IRS to withdraw your monthly payments directly from your checking account, you reduce the risk of missing a payment and incurring additional fees.

Who Should Use IRS Form 433-D?

Now that you know what Form 433-D is and why it can be beneficial, let’s discuss who should consider using this form.

Form 433-D is intended for both wage earners and self-employed individuals who need a structured way to pay off their tax debt over time. If you’re unable to pay your full tax liability immediately, this form can help you manage your financial obligations more effectively.

Businesses that owe federal income tax can also benefit from using Form 433-D. Setting up a payment plan can prevent more severe collection actions against the business, such as levies or liens.

Who Shouldn’t File Form 433-D?

While Form 433-D can be a valuable tool for many taxpayers, it may not be suitable for everyone. Here’s who might want to avoid using this form.

Taxpayers Who Can Pay Their Full Tax Debt Immediately

If you have the means to pay your full tax debt right away, it’s usually best to do so to avoid any additional interest or penalties. In such cases, there’s no need for an installment agreement.

Taxpayers Seeking a Short-Term Payment Plan

For those who need a swifter solution (120 days or less), a short-term payment plan can be a better option. You can apply for such a plan directly through the IRS website without filing Form 433-D.

Taxpayers Facing Severe Financial Hardship

If you’re experiencing financial hardship and can’t make any payments, you might qualify for currently-not-collectible status. In this situation, the IRS temporarily suspends its collection activities.

Instead of filing Form 433-D, you should complete Form 433-F (Collection Information Statement) or Form 433-A (Collection Information Statement for Wage Earners and Self-Employed Individuals) to apply for this status.

Taxpayers Seeking an Offer in Compromise

If you believe you qualify for an offer in compromise (OIC), where the IRS settles your tax debt for less than the full amount you owe, you’ll need to submit Form 656, along with Form 433-A or Form 433-B.

Businesses With Different Needs

Businesses that can’t meet the requirements of Form 433-D might find Form 433-B (Collection Information Statement for Businesses) more appropriate. This form provides a detailed view of the organization’s financial situation and can help in negotiating a different type of payment arrangement.

How to Complete Form 433-D

To simplify the process of setting up a Direct Debit Installment Agreement, here’s a step-by-step guide to help you fill out Form 433-D.

Before you get started, make sure you have all the necessary information at hand. This includes your Social Security number, bank account details, and information about your financial situation.

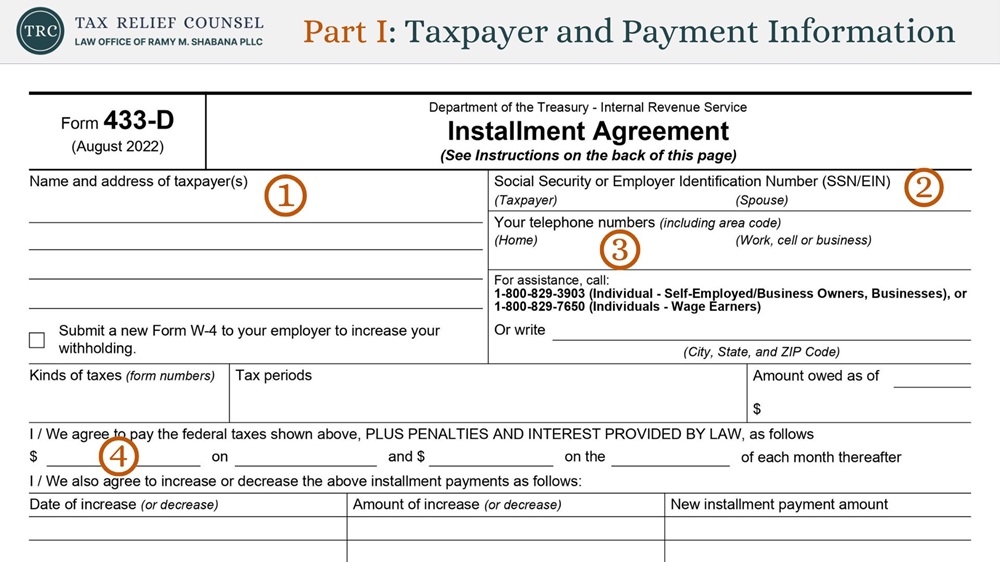

Part I: Taxpayer and Payment Information

In this section, you’ll provide your personal information, including your name, address, and contact details. Additionally, you’ll fill out the key details about the payment plan.  You’ll need to include the following information:

You’ll need to include the following information:

- Your Name and Address: Put down your full name and current address. If you’re completing the form for a business, enter its full legal name.

- Your Social Security Number: Provide your personal Social Security number or your Employer Identification Number (EIN) if you’re applying for a business.

- Your Phone Number: Enter your best contact number so the IRS can reach you if needed.

- Payment Amount and Date: Specify the amount you agree to pay each month and the date you wish the payments to be withdrawn (e.g., the 1st or 15th of each month).

It’s crucial to choose an amount and withdrawal date you can honor to ensure that you can keep up with your payments as agreed.

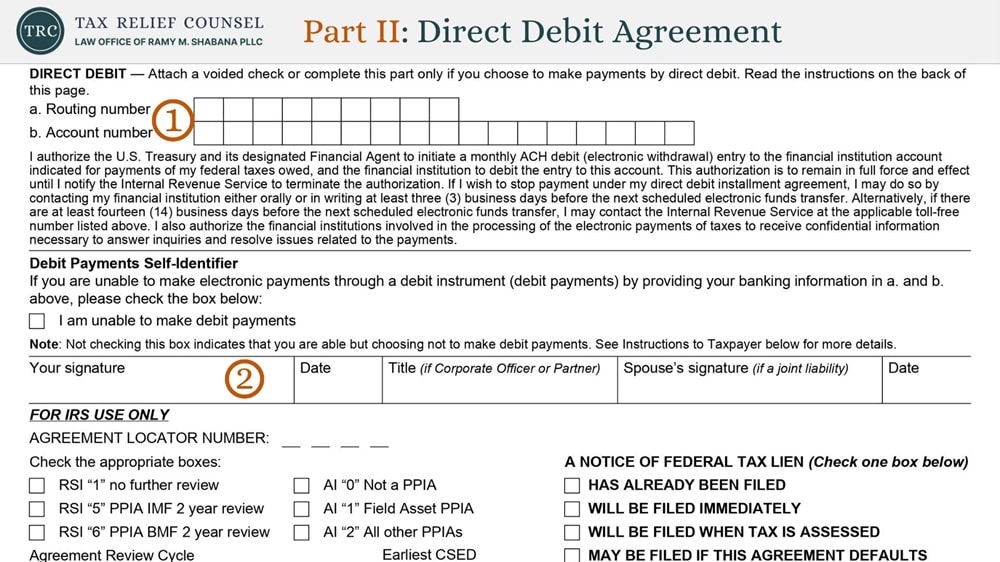

Part II: Direct Debit Agreement

This section authorizes the IRS to initiate direct debit payments from your bank account.

Provide your bank’s routing number and your account number. Confirm that these numbers are correct, as they’ll be used for making the direct debit payments. Sign and date this section to give the IRS permission to charge your account.

Submitting Form 433-D

Once you’ve completed the form, you must submit it directly to the IRS to ensure that your payment plan is processed correctly. You can mail it to the address provided in the included instructions. Double-check that you’re sending it to the right address to prevent processing delays.

If you prefer, you can also set up a payment plan online through the IRS website. This option can be quicker and more convenient, especially if you need to start making payments immediately.

What Are the Terms and Conditions of IRS Form 433-D?

When you enter into a Direct Debit Installment Agreement with the IRS using Form 433-D, there are specific terms and conditions you must adhere to. Understanding these conditions is essential for maintaining compliance and avoiding default.

Timely Payments

First and foremost, you must make all of your monthly payments on time. The IRS will automatically withdraw the agreed-upon amount from your bank account on the specified date each month. It’s vital that you have sufficient funds in your account to cover these payments.

Full Compliance with Tax Obligations

You must stay current with all your tax obligations while your installment agreement is in effect. This means filing all required tax returns on time and paying any new liabilities when they’re due.

Additional Penalties and Interest

Even with an installment agreement in place, your unpaid tax balance will continue to accrue penalties and interest until fully paid off. These additional costs will be included in your monthly payment amount.

Changes in Financial Situation

If your financial situation changes significantly, either for better or worse, you must inform the IRS promptly. You may be eligible to modify the terms of your installment agreement, either to increase or decrease your monthly payment amount.

Default and Termination

Failure to comply with the terms of the agreement, such as missing a payment or neglecting to file future tax returns, can result in default. If you default on your installment agreement, the IRS may terminate the agreement and resume collection actions, including levies and liens.

User Fee

Direct Debit Installment Agreements come with a user fee of $107, which can be deducted from your initial payments.

For low-income taxpayers (at or below 250% of federal poverty guidelines), the fee is reduced to $43. It can be waived altogether if you agree to make electronic payments via a debit instrument. If you’re a low-income taxpayer and you can’t make electronic payments, the reduced fee will be reimbursed upon completion of the agreement.

There’s an $89 reinstatement fee if you default on your agreed-upon payments. For low-income taxpayers, this fee is $43 and can also be waived with electronic payments. If electronic payments aren’t possible, the reduced reinstatement fee will be reimbursed upon completion of the agreement.

Duration of the Agreement

The length of your installment agreement will depend on your total amount of tax debt and your ability to pay. Most agreements are structured to be paid off within 72 months (six years), but this can vary based on individual circumstances.

Review and Adjustment

The IRS periodically reviews installment agreements to ensure that the terms are still appropriate based on the taxpayer’s financial situation. You may be asked to provide updated financial information during these reviews.

Managing Your Direct Debit Installment Agreement

Once you’ve set up your payment plan, it’s important to manage it properly to avoid any issues. Here are some best practices to adhere to.

Once you’ve set up your payment plan, it’s important to manage it properly to avoid any issues. Here are some best practices to adhere to.

Monitoring Your Payments

Keep an eye on your bank account to ensure that the IRS is withdrawing the correct amount each month. If there are any discrepancies, contact the agency right away to resolve the issue.

Adjusting Your Payment Plan

If your financial situation changes and you need to adjust your monthly payments, you can reach out to the IRS to request a modification to your installment agreement. Be prepared to provide updated financial information to support your request.

Benefits of Using Form 433-D

Entering into a Direct Debit Installment Agreement can offer several advantages, especially when dealing with tax debt. Two of the most notable include:

Avoiding Penalties and Interest

One of the primary benefits of using a Direct Debit Installment Agreement is avoiding additional penalties and interest on your unpaid tax balance. Consistent monthly payments can help you stay on track and reduce your overall debt.

Maintaining Compliance with the IRS

Setting up an installment agreement demonstrates to the IRS that you’re making a good-faith effort to pay your tax debt. This can prevent more aggressive collection actions and help you maintain a positive relationship with tax authorities.

Common Issues and How to Avoid Them

Even with the best intentions, issues can arise when dealing with Form 433-D. Here are some problems taxpayers frequently face and tips for preventing them.

Incomplete or Incorrect Information

One of the most common issues with Form 433-D is incomplete or incorrect information. Make it a point to review all entries before submitting the form to avoid delays or rejections.

Missed Payments

Missing a payment can result in penalties and potentially defaulting on your installment agreement. Ensure that you have sufficient funds in your bank account each month to cover the payment.

Financial Hardship

If you experience financial hardship and are unable to make your monthly payments, contact the IRS immediately. They may be able to adjust your payment plan or provide other forms of assistance.

Get Professional Assistance with Form 433-D

Form 433-D can be a much-needed lifeline for taxpayers struggling with debt. By setting up a Direct Debit Installment Agreement, you can manage your monthly payments more effectively and avoid additional penalties.

If you have any questions or concerns about IRS Form 433-D or need assistance setting up your installment agreement, Tax Relief Counsel is here to help. Our seasoned tax lawyer offers strategic legal advice and representation for both individuals and businesses dealing with complex tax matters.

Contact us today to schedule a free consultation. We’re ready to protect your interests and help you achieve financial security.