Table of Contents

The U.S. tax system can be confusing even for those who have been paying taxes most of their lives. While most taxpayers aim to fulfill their tax obligations diligently, unforeseen circumstances or honest mistakes can sometimes lead to penalties from the IRS.

The good news is that the IRS understands that life happens, and it offers a way to request relief from these penalties, known as penalty abatement. Here’s what you need to know about penalty abatement and how to seek it.

Understanding IRS Penalties

Before we dive into the finer points of penalty abatement, it’s important to understand why the IRS imposes penalties in the first place.

The IRS relies on timely and accurate filing and payment to fund government programs and services. This means that, as a taxpayer, you have certain responsibilities when it comes to filing your tax returns and paying your taxes. When taxpayers fail to comply with these requirements, various penalties may apply.

Here are some of the common penalties the IRS doles out to fraudulent, neglectful, and delinquent taxpayers:

Failure-to-File Penalty

Not filing your tax return by the deadline — even if you don’t owe — can result in a failure-to-file penalty. This applies even if you file your tax returns late with a valid extension.

Failure-to-Pay Penalty

If you owe taxes but fail to pay them by the deadline, you’ll likely be hit with a failure-to-pay penalty. This penalty will be a percentage of your unpaid tax debt.

Estimated Tax Penalty

Estimated tax penalties apply to taxpayers who haven’t paid enough taxes throughout the year, usually through withholding or estimated tax payments. They most commonly affect independent contractors and business owners.

Accuracy-Related Penalties

If you significantly understate your tax liability due to negligence or disregard for tax rules, you could face accuracy penalties. These may be imposed even if you made a good-faith effort to report your income and expenses accurately.

Other Penalties

The IRS has a range of additional penalties for specific situations, such as filing a fraudulent return or failing to comply with international tax reporting requirements.

How Does Penalty Abatement Work?

In some circumstances, it may be possible to get penalties like the ones mentioned here removed. This process involves requesting a waiver from the IRS and demonstrating that you had reasonable cause for failing to comply with the tax code and meet your tax obligation.

In other words, you’re explaining to the IRS that you had a legitimate reason for not paying your taxes, filing your return on time, or filing a correct tax return — it wasn’t due to willful neglect or intentional disregard for the law.

Reasonable Cause for Penalty Abatement: What Does the IRS Consider?

Now comes the million-dollar question: what exactly constitutes “reasonable cause” in the eyes of the IRS?

Unfortunately, there’s no one-size-fits-all answer. The IRS examines each penalty abatement request on a case-by-case basis, taking into account all the facts and circumstances of the taxpayer’s situation and applying the reasonable cause criteria.

That said, the agency will want to see that you made a reasonable attempt to comply with tax laws, acting responsibly and in good faith.

Unsure Whether Your Situation Meets the IRS's Reasonable Cause Criteria?

It’s not always clear what the IRS will consider reasonable. Contact Tax Relief Counsel today to have your case evaluated by our knowledgeable tax attorney.

Call Me Personally

Factors the IRS Considers for Tax Abatement

Here are some of the key factors the IRS considers when evaluating whether a taxpayer has reasonable cause for their tax-related errors:

Reasonable Actions

First, IRS officials will analyze your actions leading up to the penalty. Did you exercise ordinary business care and prudence in handling your taxes? Did you demonstrate good faith, making a genuine effort to comply with the relevant tax laws? Did you act in a way that most reasonable people would consider responsible under similar circumstances? These are the most important considerations.

Circumstances Beyond Your Control

Life throws everyone curveballs from time to time. The IRS recognizes that situations beyond your control can prevent you from meeting your tax obligations. Some common reasons the agency grants penalty relief include:

- Serious illness or injury: A debilitating health condition could have prevented you from filing or paying on time.

- Death of a spouse or immediate family member: The loss of a loved one could have made it difficult to handle administrative tasks, including filing tax returns.

- Natural disasters: A fire, hurricane, earthquake, or other disaster could have disrupted your life or destroyed your records.

- Unavoidable absence: Military deployment, immigration issues, or other circumstances could have pulled you away unexpectedly.

- Theft of records: Your essential tax documents could have been stolen or destroyed.

Regardless of your specific circumstances, you’ll need to be able to show proof that you were prevented from filing or paying your tax debt on time.

Reliance on IRS Advice

If you received incorrect written advice from the IRS (regarding filing requirements or payment deadlines, for example) and relied on that advice, it could constitute reasonable cause. However, simply claiming you didn’t understand the law isn’t a legitimate reason.

Compliance History

Your past tax compliance history also plays a role. If you have a history of filing and paying your taxes on time, the IRS is more likely to view your current situation with leniency.

Applying for Penalty Forgiveness: A Step-by-Step Guide

If you believe you have reasonable cause for penalty abatement, here’s how to go about requesting relief:

File a Request with the IRS

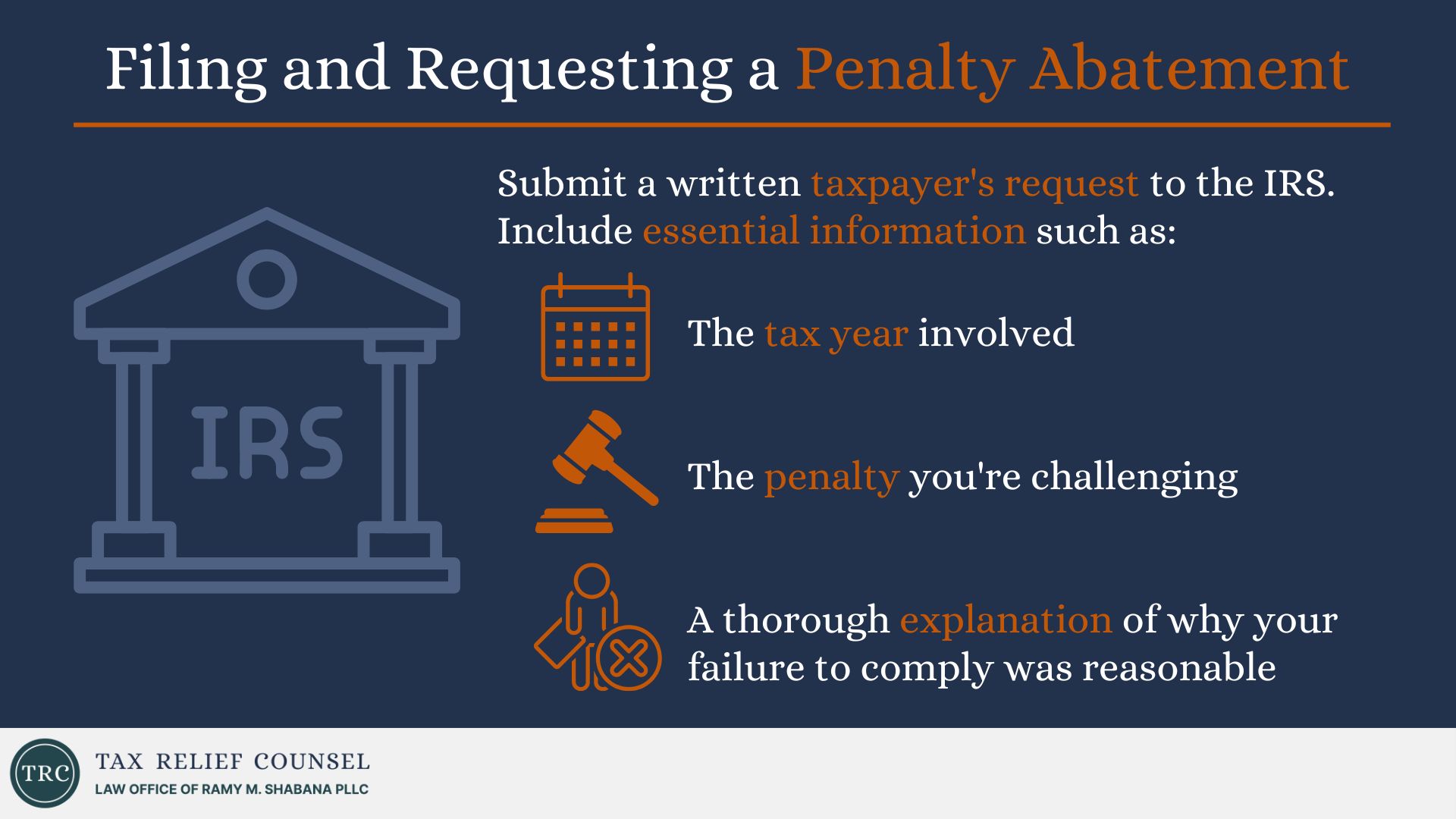

You’ll need to submit a written taxpayer’s request to the IRS clearly explaining your circumstances and reasons for not filing or paying your obligation. The IRS also has a toll-free number that you can call to speak with an agent directly.

Provide Detailed and Accurate Information

Your request should include essential information, such as the tax year involved, the specific penalty you’re challenging (e.g., failure to pay, accuracy, late filing, or another penalty), and a thorough explanation of the reasonable cause for your failure to comply. Be prepared to provide additional details and justification as needed.

Include Supporting Documentation

It’s important to gather any documentation that might strengthen your claim. This might include:

- Medical records

- Police reports

- Death certificates

- Insurance claims

- Letters from third parties who can corroborate your situation

IRS officials will expect to see evidence substantiating your reasons for not meeting your tax obligations.

When Should You Hire a Tax Professional?

While you can certainly attempt to request penalty abatement yourself, seeking guidance from a qualified tax professional is often a wise decision. This is especially true if any of the following conditions apply to you:

Your Situation Is Complex or Unusual

If you’re facing multiple penalties or a significant tax liability or you have an unusual reason for your non-compliance, you might be better off hiring a qualified tax professional to manage your case.

You’re Confused by Tax Laws

Navigating federal tax laws and IRS procedures can feel overwhelming. A tax professional can guide you through the process and handle all necessary communication with the IRS on your behalf.

You Want to Maximize Your Chances of Success

An experienced tax professional will know how to present your case to the IRS in the best possible light, increasing the likelihood of securing a much-needed penalty abatement.

How a Tax Professional Can Help

No matter what events led to your tax issue, Ramy Shabana, seasoned tax attorney and founder of Tax Relief Counsel, can assist you in resolving it by seeking penalty abatement. Here’s how:

Determining Eligibility

Ramy will start by reviewing your circumstances to assess whether you have a valid reasonable cause argument based on the IRS’s criteria.

Preparing Your Request

If you qualify for abatement, Ramy and his team will prepare a thorough and compelling request for penalty abatement on your behalf, including all necessary supporting documentation.

Representing You Before the IRS

Ramy can handle all communication with the IRS, answer any questions they might have, and advocate for your best interests throughout the process. He can also help you understand the complexities of taxation and ensure that your rights are protected.

Don’t Let the Stress of IRS Penalties Weigh You Down

Just because the IRS has imposed penalties on you doesn’t mean there’s nothing you can do.

The experienced legal professionals at Tax Relief Counsel understand the intricacies of tax law and the reasonable cause criteria the IRS uses to evaluate penalty abatement requests. We can help you understand your rights, determine the best course of action, and present a strong case to the IRS.

Contact us today to arrange a free, confidential consultation and let us help you petition for penalty relief.

Disclaimer: This blog post is for informational purposes only and does not constitute tax advice. Consult a qualified tax professional for advice regarding your specific situation.