When it comes to taxes, the line between legal strategies and illegal activities can sometimes become blurred. Even so, taxpayers and business owners must comply with the law, and this is easier when you understand the difference between tax evasion and tax fraud.

Tax Relief Counsel is here to demystify these two serious crimes and help you comply with tax regulations.

Table of Contents

What Is Tax Evasion?

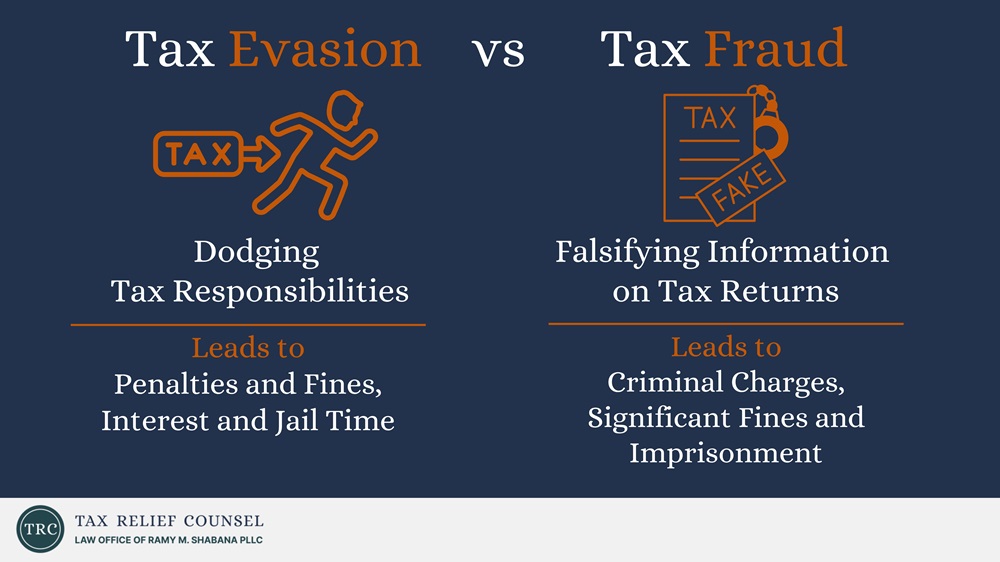

Tax evasion involves dodging tax responsibilities. It’s when taxpayers take deliberate actions to avoid paying the government what they owe.

Examples of Tax Evasion

Tax evasion can take many forms, from not reporting all sources of income to claiming fake deductions. Some common examples include:

- Underreporting income from freelance work

- Claiming personal expenses as business expenses

- Using offshore tax havens to conceal assets

Some taxpayers commit tax evasion when they fail to file their taxes. Others might know that they owe past-due taxes but neglect to pay them.

Consequences of Tax Evasion

Getting caught evading taxes can lead to severe penalties, including hefty fines, interest on unpaid taxes, and even jail time. The IRS takes tax evasion very seriously and employs state-of-the-art methods to catch offenders.

What Is Tax Fraud?

Tax fraud involves intentionally falsifying information on a tax return to reduce tax liability. It’s a step beyond evasion, where false information is submitted to mislead the tax authorities.

Examples of Tax Fraud

Tax fraud can be more elaborate and intentional than tax evasion. Examples include:

- Falsifying income or deductions

- Using a false Social Security number

- Filing false tax returns

Both individuals and businesses can commit tax fraud — and both can face the consequences.

Consequences of Tax Fraud

Criminal tax fraud can result in federal charges, leading to years in prison and a criminal record. The penalties can also include significant fines.

Tax Evasion vs. Tax Fraud: Key Differences

While both tax evasion and tax fraud are illegal activities done to avoid paying taxes, the key differences lie in the method and intent. Tax evasion is about concealing income or inflating deductions, whereas tax fraud is about deliberately falsifying information.

Intent and Evidence

To convict someone for tax fraud, the government must prove that they deliberately engaged in deceptive practices in order to pay fewer taxes.

In contrast, tax evasion is an illegal attempt to avoid paying taxes. The presence of intent is less important, and it can include actions such as failing to report income.

Legal and Civil Implications

Tax fraud often leads to criminal charges. Tax evasion can result in both civil and criminal penalties. These civil penalties typically involve fines, while criminal penalties can include jail time.

How the IRS Detects Tax Crimes

The IRS is vigilant in identifying and prosecuting tax crimes. The agency’s Criminal Investigation division specializes in uncovering fraudulent activities.

IRS Criminal Investigation agents use a variety of tools, including audits, data matching, and whistleblower tips, to detect tax fraud and evasion. These employees are trained to analyze discrepancies in tax returns and investigate suspicious activities.

What Happens If I’m Being Investigated by the IRS?

An IRS investigation can lead to fines, penalties, and even criminal charges. It’s essential to cooperate fully and seek legal counsel if you find yourself under investigation.

Civil and Criminal Penalties

Civil penalties for tax crimes can include fines, interest on unpaid taxes, and asset seizure. Criminal penalties can involve imprisonment, probation, and a permanent record.

Impact on Personal and Professional Life

A conviction for tax crimes can damage your reputation, affect your career, and create financial hardships. It’s crucial to comply with tax laws to avoid these consequences.

Common Tax Evasion and Fraud Schemes

Taxpayers employ various schemes to evade taxes or commit fraud. Understanding these schemes can help you avoid unintentionally crossing legal lines.

Offshore Tax Havens

Using offshore accounts to hide income is a common tactic. While having offshore accounts is legal, failing to report them is not.

Abusive Tax Schemes

Some taxpayers use abusive tax schemes, such as fake charities or fraudulent deductions, to reduce their tax liability. The IRS monitors and targets these schemes.

Tax Avoidance vs. Tax Evasion and Fraud

Unlike tax evasion and tax fraud, tax avoidance is not a crime. It involves using strategic methods to reduce tax liability, such as maximizing deductions or contributing to retirement accounts.

It’s crucial to know the difference between legal tax avoidance and illegal tax evasion or fraud.

Legal Tax Avoidance Strategies

Tax credits, deductions, and retirement contributions are examples of legal tax avoidance strategies. These methods reduce your tax bill without breaking the law.

When Avoidance Crosses the Line

Tax avoidance crosses into evasion or fraud when it involves illegal activities or false information. Always make sure your tax strategies comply with the law.

Why Accuracy Is Important in Tax Reporting

Accurate tax reporting is essential to avoid financial and criminal penalties. Ensuring your tax returns are correct and complete is the best way to stay on the right side of the law.

Common Mistakes to Avoid

Common tax reporting mistakes include underreporting income, failing to keep proper records, and missing deadlines. Double-check your information and work with a tax professional if needed.

Seeking Professional Help

Tax laws can be complex, and an accountant or a tax lawyer can help you comply with regulations. These professionals know how to explain complicated tax situations and will work with you to make choices that reduce your tax liability while following the law.

Why Should I Get Professional Tax Assistance?

Tax professionals play a crucial role in helping taxpayers avoid legal trouble. They can provide guidance, prepare accurate tax returns, and represent your interests in case of an audit.

A tax crime can have severe consequences, impacting both your finances and freedom. Working with a tax professional can save you time, reduce your tax liability, and provide peace of mind.

When selecting a tax professional, focus on their qualifications, experience, and track record. Look through directories of Certified Public Accountants (CPAs), Enrolled Agents (EAs), and tax attorneys to find one who can meet your needs.

How Can I Protect Myself from Tax Crime Accusations?

Protecting yourself from being accused of a tax crime starts with understanding the law and maintaining accurate records. Steer clear of suspicious activities, and seek guidance from a professional if you have concerns.

Maintain Accurate Records

Accurate recordkeeping is essential for tax compliance. Keep detailed records of income, expenses, and deductions to support your tax returns.

Understand Tax Laws

Staying informed about tax laws can help you avoid unintentional violations. Regularly review changes in tax regulations and seek professional advice when needed.

Don’t Leave It to Chance — Get a Tax Lawyer

Tax evasion and tax fraud are serious offenses with significant consequences. Always strive for accurate and honest tax reporting, and seek professional help when appropriate.

If you have questions about tax evasion or tax fraud, our experienced tax lawyer in Washington, D.C., is here to provide clarity and guidance. Contact us to set up a free, no-obligation consultation and get help exploring ways to stay on good terms with the IRS.