Table of Contents

Tax fraud is a serious offense that can result in significant penalties — both civil and criminal. The Internal Revenue Service (IRS) takes tax fraud very seriously, as it undermines the country’s ability to fund public services.

Whether intentional or accidental, providing false information on a tax return can have lasting consequences. If you’re facing accusations of tax fraud, work with a tax attorney to build a defense and fight for a fair outcome.

Tax Relief Counsel explains everything you need to know about the consequences of tax fraud and offers some tips on how to protect yourself.

What Is Tax Fraud?

Tax fraud occurs when an individual or business intentionally falsifies information on a tax return to avoid paying the full amount of taxes owed. This can include underreporting income, inflating deductions, claiming false credits, or hiding money in offshore accounts.

The key factor in tax fraud is the intent to deceive; mistakes or misunderstandings in tax filings are usually considered negligence, not fraud.

Is There a Difference Between Tax Fraud and Tax Evasion?

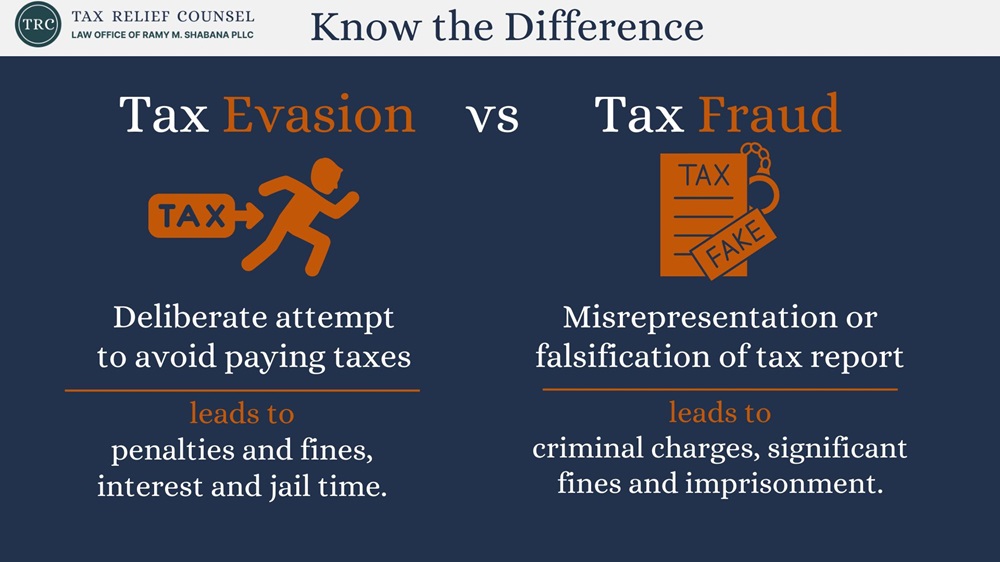

While the terms “tax fraud” and “tax evasion” are often used interchangeably, they have distinct legal meanings. Tax evasion is a serious federal crime, and it involves a deliberate attempt to avoid paying taxes. It may include activities such as concealing income, falsifying financial documents, or moving assets offshore to avoid taxation.

Tax evasion is a broader term that refers to any illegal means of avoiding paying taxes, which can include fraudulent actions. Tax fraud, on the other hand, involves the deliberate misrepresentation of financial information on tax filings.

Civil Tax Penalties vs. Criminal Tax Penalties

Tax fraud can result in either civil penalties, criminal penalties, or both. The key differences lie in the severity of the offense and the strength of the IRS’s case.

Civil Tax Penalties

When there is no criminal intent but the taxpayer has significantly understated their tax liability, the IRS may pursue a civil case against the taxpayer. If the IRS wins the case, the taxpayer may face significant fines — much higher than the amount of taxes they underpaid. Civil penalties can be severe, but they don’t result in jail time.

Criminal Tax Penalties

Criminal penalties are reserved for more serious cases where the taxpayer has willfully engaged in fraudulent activities, such as filing false tax returns. A conviction for criminal tax fraud carries the risk of prison time, hefty fines, and a criminal record.

Common Forms of Tax Fraud

Tax fraud can take many forms, and it’s not limited to just big corporations or wealthy individuals. Here are some of the most common types of tax fraud:

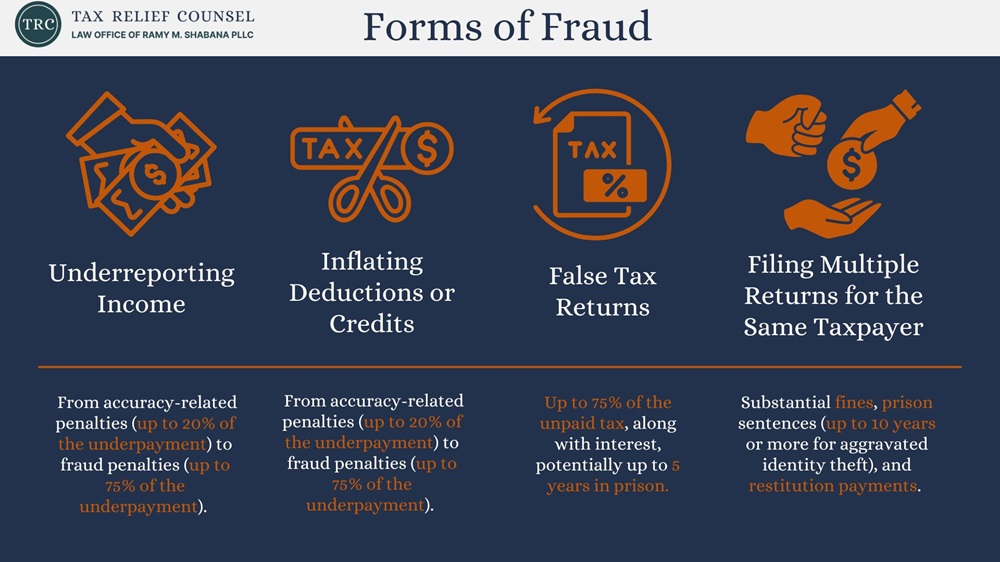

- Underreporting income: Failing to report all forms of income, whether from a traditional job or side gigs, constitutes tax fraud.

- Inflating deductions or credits: Deliberately claiming deductions or credits that you’re not entitled to is another common form of tax fraud.

- Filing false tax returns: Submitting a tax return with incorrect or fabricated information to lower your tax burden is illegal.

- Filing multiple returns: Filing multiple tax returns using false identities to claim refunds can lead to criminal charges.

Federal laws do not state a minimum amount for prosecuting tax fraud. However, larger amounts are more likely to draw the attention of the IRS.

Penalties for Tax Fraud

The penalties for committing tax fraud depend on whether the case is treated as a civil or criminal tax offense.

Civil Tax Fraud Penalties

In a civil tax fraud case, the IRS may impose a penalty of up to 75% of the underpayment. Additionally, interest continues to accrue on any unpaid taxes until the full amount is paid. Civil tax fraud cases have a lower burden of proof than criminal cases.

Criminal Tax Fraud Penalties

Criminal penalties are much more severe. Individuals convicted of willful tax evasion could face:

- Prison sentences: Up to five years in federal prison.

- Fines: Fines of up to $250,000 or twice the amount the individual gained.

- Probation: Years of probation instead of or in addition to prison.

To win a criminal tax fraud case, the IRS must prove beyond a reasonable doubt that the defendant intended to commit a tax crime.

Signs of a Potential IRS Tax Fraud Investigation

The IRS Criminal Investigation Division handles cases of tax fraud and criminal tax evasion. The division uses various tools to detect and investigate fraudulent tax activity, including audits, criminal investigations, and collaboration with other federal agencies.

If the IRS suspects fraud, it will thoroughly examine your financial records, bank accounts, and other documents for evidence. Some key signs that the IRS might be investigating you for tax fraud include:

- You receive a notice of an IRS audit.

- The IRS requests additional documentation beyond what’s typically required.

- The IRS reaches out to third parties, such as your employer or bank, to gather information.

If you notice any of these warning signs, consult with a qualified tax attorney at Tax Relief Counsel.

Defend Yourself Against IRS Tax Fraud Penalties

Don’t let tax fraud charges derail your life. The experienced tax attorney at Tax Relief Counsel is here to help you fight back. Reach out now to take the first step toward resolving your IRS issues.

Call Me Personally

Defenses Against Tax Fraud Charges

If you’re facing charges of criminal tax fraud, your attorney will explore potential defenses that could reduce the penalties or get the IRS to drop the case. Some common defenses include:

- Lack of intent: Showing that any errors on your tax return were accidental, not intentional.

- Good faith: Arguing that you relied on a tax preparer or other professional in good faith and were unaware of the errors.

- Statute of limitations: Establishing that the deadline for filing criminal charges has passed.

Most criminal tax charges have a statute of limitations of six years. However, the IRS has an indefinite amount of time to pursue civil tax fraud cases.

Can Honest Mistakes Lead to Penalties?

Honest mistakes generally do not result in criminal charges for tax fraud. However, the IRS can assess financial penalties if you underpay your taxes.

The IRS distinguishes between honest errors and intentional fraud, and in cases of fraud, the penalties are far more severe.

The Maximum Penalty for Tax Fraud

The maximum penalty for criminal tax fraud includes both significant fines and imprisonment. Someone convicted of filing false tax returns or committing willful tax evasion may face a prison sentence of up to five years and fines of up to $250,000. A corporation might pay a fine of up to $500,000.

Alternatively, the IRS can assess financial penalties of up to twice the amount the defendant gained through fraud.

Examples of Tax Fraud Cases

Tax fraud cases are not limited to corporate executives or criminal enterprises. Everyday individuals can find themselves entangled in tax fraud cases for things like inflating business expenses or intentionally underreporting income.

Some well-known cases involve public figures who were prosecuted for willful failure to pay taxes or making false statements on tax documents.

For example, actor Nicholas Cage made headlines when the IRS claimed he owed $14 million in back taxes in 2009. Cage had to sell properties and assets to resolve his tax debts, and his reputation was harmed. While the actor wasn’t prosecuted criminally, Cage’s situation highlights the dangers of not properly managing tax obligations.

Avoiding Tax Fraud: Tips for Compliance

To avoid being accused of tax fraud, follow these simple guidelines:

- File tax returns on time and ensure they are accurate.

- Report income fully, even if it comes from nontraditional sources like freelancing or side businesses.

- Claim deductions honestly and avoid inflating or misreporting business expenses.

- If you use a tax preparer, make sure they are licensed and knowledgeable about current tax laws.

Additionally, save every document that backs up the information you provide on your tax returns. Keep your documents organized so that you will be prepared in the case of an audit.

When You’re Facing Tax Fraud Charges, Get a Qualified Tax Attorney

Whether you’re an individual taxpayer or a business owner, it’s essential to ensure your tax returns are accurate and comply with federal tax laws. If you’re concerned about your tax filings or if you’re facing an investigation for tax fraud, seek legal advice from a qualified tax attorney.

Your attorney can explain the charges you’re facing, develop a defense strategy, and negotiate with the government on your behalf. They will advocate for your rights and fight against additional penalties or criminal prosecution.

At Tax Relief Counsel, we defend clients against serious IRS charges. Contact us today for a free consultation and let us protect your rights.