Table of Contents

Few things strike fear into the hearts of taxpayers quite like receiving an audit letter from the Internal Revenue Service (IRS). It feels like a financial gut punch, especially for small business owners juggling countless responsibilities.

But before you spiral into a panic about what happens if you get audited and don’t have receipts for every single transaction, take a breath. Getting an audit notice doesn’t automatically mean you’re in trouble.

Decoding the IRS Audit: Why Did You Get That Dreaded Letter?

Let’s demystify the audit process. An IRS audit, or tax audit, is simply how the Internal Revenue Service ensures the accuracy of filed tax returns. This could involve income tax returns, business tax returns, or any other type of tax filing.

Contrary to popular belief, the IRS isn’t out to get you. Their primary goal isn’t to penalize taxpayers but to determine your correct tax liability. So what might trigger an IRS audit? There are a few common red flags:

High-Claimed Deductions

If your deductions seem excessively high compared to your income or are out of line with averages for your industry, it might pique the IRS’s interest. For example, if you claim expenses that seem unusually high or if the IRS suspects you’re trying to claim tax deductions you’re not entitled to receive, it might begin an audit.

Inconsistencies with Previous Tax Returns

Noticeable discrepancies or errors on your current tax return compared to previous ones can raise eyebrows. The IRS may launch IRS audits if they notice significant variations in income reporting or claimed deductions across multiple years.

Random Selection

Yes, sometimes audits are simply random. The IRS uses statistical formulas to select returns for audits to ensure overall tax compliance. Even if you’ve been diligent with filing taxes accurately, there’s always a chance of being selected.

Receipts: Your Best Friend During an IRS Audit

Imagine this: You walk into an IRS office for your tax audit, armed with a neatly organized folder brimming with receipts. Sounds like a dream scenario, right? That’s because it is. The tax code requires you to have proper documentation when you claim deductions on your tax return, and receipts are the gold standard.

IRS auditors use receipts to verify your claimed expenses and make sure you haven’t underreported your taxable income. They help demonstrate that the expenses taxpayers claim are accurate.

Maintaining accurate financial records, including those all-important receipts for various business expenses (or expenses related to your industry), charitable contributions, and other items you’re deducting, will not only make the tax audit process much smoother but also provide peace of mind.

Claim Business Expenses, but Be Prepared

Small business owners and business partners, this section is especially for you. You’re likely well-versed in the many business expense deductions available to legally reduce your tax bill when you file your business tax return. Common deductions businesses claim on their business tax returns include:

- Business purchases: Equipment, supplies, inventory, software, etc.

- Travel expenses: Flights, hotels, meals (subject to limitations), and transportation related to business trips.

- Entertainment expenses: Client meals or events (also subject to limitations and must be directly related to business).

- Home office deductions: Insurance, repairs, and maintenance for home office space.

Remember, when you claim tax deductions for these and other business expenses, be prepared to back them up if you get audited.

No Receipts? Navigating the IRS Audit Without Them

Okay, let’s address the elephant in the room. It’s not uncommon to misplace receipts or find yourself in a situation where you didn’t receive one in the first place. But what happens if you get audited and don’t have those ideal receipts to show?

Don’t panic. It’s not an automatic audit failure. While receipts are the most straightforward proof, the IRS might consider other forms of documentation.

What Can You Use If the IRS Asks to “Verify Receipts”?

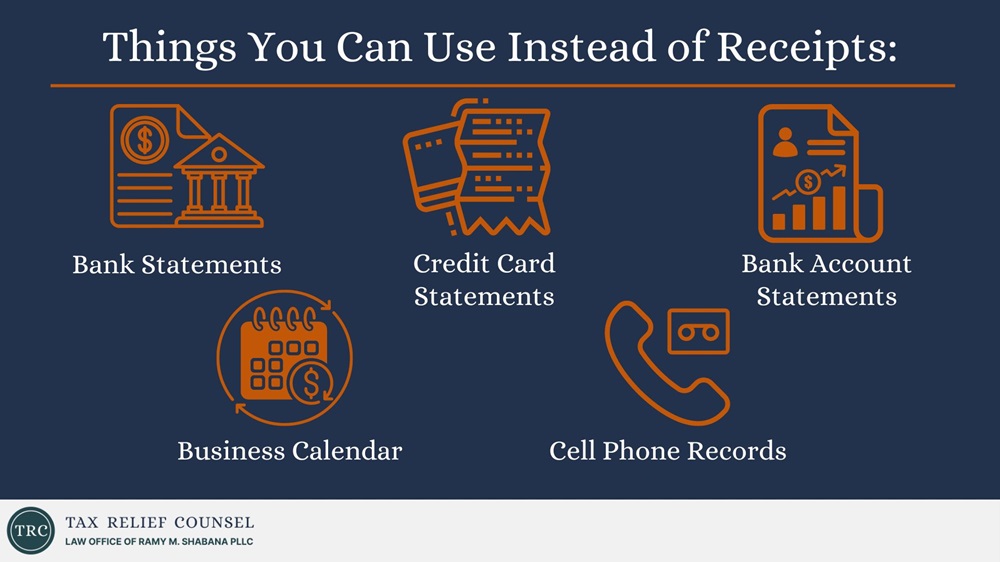

Here are some options to consider if you’re missing receipts:

- Bank statements: These provide a clear record of transactions, showing payments made to vendors or for business-related expenses.

- Credit card statements: Similar to bank statements, credit card statements offer a chronological record of business purchases.

- Bank account statements: If you have a separate business bank account (which is always recommended), the statements from that account can be incredibly helpful.

- Business calendar: A detailed calendar noting meetings, appointments, or travel can help establish the business purpose of certain expenses.

- Cell phone records: While not ideal for every expense, cell phone records can help substantiate business calls, travel to client sites, or work-related communication.

Remember, the key is to provide the Internal Revenue Service with any organized records that support your claimed deductions.

Feeling Overwhelmed? Don't Face the IRS Alone.

Contact us today for a free consultation with an experienced tax attorney. We understand how stressful it can be to be audited by the IRS. We’re here to simplify the process and advocate for you.

Call Me Personally

How to Navigate an Audit with Missing Receipts: Tips from Ramy Shabana

Facing the IRS can feel intimidating, especially if you’re missing documentation. Here’s where seeking professional help becomes invaluable.

1. Hire a Tax Attorney

A qualified tax attorney or tax lawyer focuses on helping clients navigate the complexities of tax law and IRS procedures. They can:

- Explain your rights: Tax law can be confusing! A tax attorney can clearly explain your rights and responsibilities during an audit.

- Develop a strategy: They’ll work with you to develop the most effective strategy for responding to the IRS audit notice and presenting your case.

- Represent you before the IRS: Your attorney can handle communication, attend hearings, and advocate for you, potentially even ending up in tax court if necessary.

You don’t have to face the IRS alone. Hiring a tax attorney can be the first step to resolving your audit successfully.

2. Organize Your Records

Even without receipts for every expense, gathering and organizing your existing financial documents and business records can make a significant difference. This includes:

- All bank statements: Personal and business accounts.

- Credit card statements: Any cards used for business purposes.

- Canceled checks: If you still use checks for some transactions.

- Invoices: Business purchases, services rendered, or contractor payments.

- Contracts: Agreements outlining business transactions or terms.

- Personal diary or business calendar: To help refresh your memory of events, meetings, or business-related activities, if applicable.

It might be challenging to think of every document that could be relevant. We have significant experience in this arena and will help you gather supporting documents you might otherwise miss.

3. Avoid Tax Fraud at All Costs

It might be tempting to consider creating fake receipts to cover missing documentation, but you should resist that urge at all costs.

Submitting fake receipts is a serious offense (tax fraud). Additionally, intentionally misrepresenting your finances to illegally reduce your tax liability is tax evasion, a federal crime with severe consequences.

While an IRS agent might not dig into your social media history during a routine audit, inconsistencies between your online presence (especially if you’re showcasing a lavish lifestyle) and your reported income could raise red flags. An IRS auditor might review public information if they suspect something is amiss that points to fraud.

Can the IRS Verify Receipts with “Reasonable Estimates”?

In situations where documentation is limited, the Internal Revenue Service might allow you to use “reasonable estimates” for certain expenses. However, this is not a free pass. To use estimates, you need to:

- Justify the lack of documentation: Clearly explain why you don’t have receipts for those specific expenses. Was there a fire? A natural disaster?

- Provide a sound basis: Your estimates can’t be random numbers; you must provide a reasonable and justifiable basis for how you arrived at those figures.

- Align with tax code: The IRS has guidelines for various business expenses. Make sure your estimates fall within acceptable ranges.

It’s important to note that the IRS might not accept your estimates. If they determine your estimates are not reasonable, they can issue an IRS audit ruling that could result in:

- Disallowed deductions: The IRS might disallow some or all of the deductions you claimed if they find insufficient evidence.

- Additional taxes: Disallowed deductions will increase your taxable income, leading to a higher tax bill or new tax bill.

- IRS audit penalties: Depending on the severity of the discrepancies and your intent, the IRS might impose tax penalties, which can be a percentage of the unpaid taxes.

Penalties can add up quickly, so it’s crucial to approach your tax filing with accuracy from the start. In some cases, severe tax evasion can even lead to criminal penalties.

Protect Yourself in the Future: Best Practices for Taxpayers

What’s the best way to handle an IRS audit? Prevent it in the first place! While you can’t completely eliminate the risk of an audit, following best practices for record-keeping and tax compliance can significantly reduce your chances.

- Establish a system: Don’t just shove receipts into a shoebox; develop a system for tracking your business income and expenses from day one.

- Use technology: Consider using accounting software or automated payment systems that automatically create digital records of your transactions.

- Mileage records matter: If you claim mileage, meticulously track every mile driven for business purposes using a mileage tracking app or a dedicated logbook.

- Financial statements must align: Ensure that your business financial statements accurately reflect your tax returns, as any inconsistencies can be red flags for the IRS.

A qualified tax professional can provide ongoing guidance on allowable expenses, tax law changes, and best practices for maintaining squeaky-clean records.

Ready to Take Control of Your Taxes and Reduce Your Audit Risk?

Don’t let the fear of an IRS audit control your life. By staying organized, understanding your responsibilities, and seeking professional guidance when needed, you can approach tax season with confidence.

At Tax Relief Counsel, we’re here to ensure you’re well-prepared for any situation. Schedule a tax planning session with Ramy Shabana today, and let us help you stay ahead of the game.

Disclaimer: This blog post is intended for informational purposes only and does not constitute legal advice. Consult with a qualified tax professional for guidance on your specific tax situation.