Businesses and individuals who deal with large cash transactions need to be aware of reporting requirements to ensure compliance with anti-money laundering regulations. One such requirement involves Form 8300, a crucial tool used by the Internal Revenue Service (IRS) to track potentially suspicious financial activities.

If you’re facing concerns related to Form 8300 or require legal guidance on tax fraud matters, our dedicated tax fraud lawyer is here to help.

Table of Contents

Understanding Form 8300

What Is Form 8300?

Form 8300 is titled “Report of Cash Payments Over $10,000 Received in a Trade or Business.” This IRS form is used to report cash transactions involving both individuals and businesses. The government uses the information obtained through Form 8300 to track the movement of large amounts of cash in order to combat money laundering, tax evasion, and other illegal activities.

Who Needs to File Form 8300?

Generally, any person engaged in a trade or business who receives more than $10,000 in cash in a single transaction or related transactions within 24 hours is required to file Form 8300. A few examples include:

- Retail businesses

- Vehicle dealerships

- Real estate professionals

- Law firms

- Casinos

- Travel agencies

There are certain exemptions and exclusions to the filing requirements, so it’s essential to consult the official IRS guidelines or seek professional advice to determine your specific obligations.

Protect Your Business from Tax Fraud Risks

Understanding and complying with complex tax regulations like Form 8300 will help you protect your business from legal issues and financial penalties. Our tax attorney provides knowledgeable guidance tailored to your specific needs. Contact Tax Relief Counsel today to schedule a consultation and keep your business compliant and secure.

Call Me Personally

Form 8300 Rules and Instructions

Some situations involving Form 8300 are simple and clear, while others can be somewhat confusing.

When to File Form 8300

Form 8300 must be filed within 15 days after the cash transaction exceeding $10,000 is received. If the 15th day falls on a weekend or holiday, the due date is the next business day.

Defining a Cash Transaction

For Form 8300 reporting purposes, a “cash transaction” includes more than just physical currency. It also encompasses cash equivalents such as:

- Cashier’s checks

- Bank drafts

- Traveler’s checks

- Money orders

However, the rules regarding noncash transactions are far from simple. For example, a cashier’s check for $11,000 for a used car would not trigger reporting requirements. But if the customer paid for the car with $8,000 in cash combined with a cashier’s check for $3,000, the recipient should fill out Form 8300. A tax compliance lawyer can explain how the rules apply to a specific tricky transaction.

How to Complete Form 8300

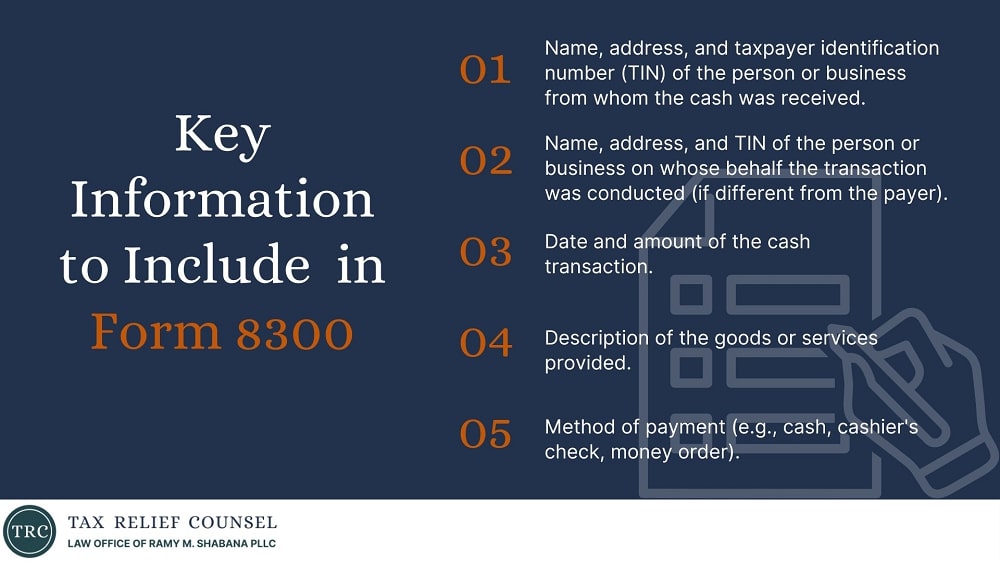

Form 8300 requires detailed information about both the payer and the recipient of the cash payment, as well as specifics about the transaction itself:

- Name, address, and taxpayer identification number (TIN) of the person or business from whom the cash was received

- Name, address, and TIN of the person or business on whose behalf the transaction was conducted (if different from the payer)

- Date and amount of the cash transaction

- Description of the goods or services provided

- Method of payment (e.g., cash, cashier’s check, money order)

- Whether the filer believes this transaction is suspicious

The IRS provides detailed instructions for completing Form 8300, and the form can be filed electronically through the Financial Crimes Enforcement Network (FinCEN) BSA E-Filing System. This system provides a secure and user-friendly platform for submitting required reports.

New E-Filing Requirements for Form 8300 in 2024

The Anti-Money Laundering Act of 2020 mandated electronic filing for Form 8300 after January 1, 2024. This means businesses no longer have the option to file paper forms. This shift toward mandatory e-filing aims to improve the cash reporting process in multiple ways:

- Faster Processing: Electronic submissions are processed significantly faster than paper forms

- Reduced Errors: E-filing systems often include built-in checks to help prevent common errors and ensure accuracy

- Enhanced Security: Electronic filing offers a more secure method of transmitting sensitive financial information

- Increased Convenience: E-filing eliminates the need for printing, mailing, and storing paper forms

Businesses and individuals who have previously filed paper Form 8300 should ensure they have completely transitioned to the mandatory e-filing system:

- Register for FinCEN’s BSA E-Filing System: If your business is not already registered, you’ll need to create an account and obtain the necessary credentials for filing electronically

- Familiarize Yourself With the E-Filing Process: FinCEN provides resources and guidance to help businesses navigate the e-filing system

- Check Your Software and Hardware: Make sure your computer system meets the technical requirements for e-filing

If you have issues while signing up or filing a report, you can refer to the FinCEN Support Center or submit a ticket to the support team.

Implications of Form 8300

While the implications of Form 8300 might seem intimidating, hundreds of thousands of these forms are routinely filed every year. Whether you’re the payee or recipient, the most important thing is to comply with reporting requirements.

What Happens If a Form 8300 Is Filed on You?

It’s important to understand that having a Form 8300 filed on you does not usually indicate suspicion of illegal activity. There are many legitimate reasons for individuals or businesses to engage in large cash transactions. However, the IRS may use Form 8300 information to investigate potential tax evasion or money laundering activities.

What Are the Penalties for Noncompliance?

Failing to comply with Form 8300 filing requirements can result in significant civil penalties. The penalty amount depends on factors such as the amount of the transaction and the degree of willfulness involved. In cases involving intentional disregard of the rules, criminal penalties may also apply.

Navigate Form 8300 with Confidence

Form 8300 plays a crucial role in maintaining financial transparency and combating illegal activities. Individuals and business owners who deal with large cash transactions must know their obligations regarding cash reporting. The potential consequences of noncompliance underscore the importance of seeking professional guidance.

If you have any questions or concerns about Form 8300 or if you require assistance with navigating cash reporting requirements and ensuring compliance, our seasoned tax fraud attorney at Tax Relief Counsel is here to help. We provide strategic legal counsel and representation to individuals and businesses facing complex tax matters. Contact us today for a free consultation and let us work to safeguard your interests and protect your financial well-being.

Frequently Asked Questions

Are there any exemptions to Form 8300 filing requirements?

Yes, certain transactions are exempt from Form 8300 reporting, such as transactions conducted with financial institutions or those occurring between certain types of businesses.

What happens if I receive multiple cash payments below $10,000 that appear to be related?

If you have reason to believe that multiple cash payments are part of a single transaction or related transactions exceeding $10,000, you are required to aggregate the amounts and file Form 8300.

Where can I find more information about Form 8300?

The IRS website provides comprehensive information and resources regarding Form 8300, including instructions, FAQs, and the latest updates to regulations. Additionally, a tax compliance attorney can help you understand these regulations and how they apply to you.