Tax Relief Counsel:

IRS Appeal Lawyer

Navigating an IRS appeal can be daunting. The skilled tax appeal lawyer at Tax Relief Counsel provides reliable legal guidance and representation in Washington, D.C., and across the U.S. to protect your rights and achieve the best possible outcome for your case.

Types of IRS Decisions Eligible for Appeal

An appeal is a formal opportunity to challenge an IRS decision you disagree with. It’s essentially a way to push back if you believe the IRS has made a mistake regarding your tax situation.

The following are a few of the types of IRS decisions that are eligible for appeal:

Proposed Adjustments to Tax Liability

Taxpayers can appeal IRS determinations regarding proposed changes or adjustments to their tax liability, such as adjustments to income, deductions, credits, or tax calculations.

Disagreement with an Audit Finding

If the IRS audits your tax return and proposes adjustments you don’t agree with, you can appeal those findings.

Denial of Deductions, Credits, or Exemptions

If the IRS denies a taxpayer’s claimed deductions, credits, or exemptions, the taxpayer has the right to appeal this decision and provide supporting documentation to substantiate their claims.

Penalties for Non-Compliance

IRS penalties imposed for various forms of non-compliance, such as late filing, underpayment of taxes, or accuracy-related penalties, can be appealed if the taxpayer believes they were assessed unfairly or inaccurately.

Collection Actions

Taxpayers can appeal IRS collection actions, including liens, levies, or seizures of property, if they believe the IRS has acted improperly or they wish to negotiate alternative payment arrangements.

Innocent Spouse Relief Determinations

In cases where one spouse seeks relief from joint and several liability for a tax debt, they can appeal the IRS’s determination regarding innocent spouse relief eligibility if their request is denied.

Don't Take on the IRS Alone. Get Help from Our Appeal Lawyer

Eliminate the stress of your upcoming IRS appeal by letting Tax Relief Counsel handle it. Get a free consultation today!

Call Me Personally

Challenging an Audit in the IRS Appeals Division

Filing an appeal with the IRS is your way of formally contesting their decision and requesting a review. This action also suspends any collection efforts on the disputed tax debt. Appeals commonly arise from audits that result in higher tax liabilities, including associated penalties and interest.

You typically have 30 days following the receipt of an IRS audit determination to initiate an appeal. It’s wise to promptly engage an IRS appeals attorney to make sure you have a strong case that’s presented to an Appeals Officer in a compelling manner. The Appeals Officer assigned to your case has the authority to make the final decision.

One significant advantage of pursuing an appeal is the impartial nature of the IRS Appeals Division. Unlike other branches, they prioritize equitable resolution regarding revenue collection, enhancing the potential for a fair outcome.

While having your case transferred to the Appeals Division may require some waiting, you and your IRS appeal lawyer can use this period strategically. It gives you a chance to gather evidence, formulate a robust approach for the appeals conference, and prepare for potential financial liabilities.

Contesting an IRS Levy

If someone owes taxes and doesn’t pay them within 30 days of getting a Final Notice of Intent to Levy and Notice of Your Right to a Hearing, the IRS can take their assets. But there are ways for taxpayers to argue against this, like using the Collection Due Process (CDP) or the Collection Appeals Program (CAP).

Collection Due Process (CDP)

Taxpayers who receive levy notices can access the CDP. As per Section 6330 of the Internal Revenue Code, taxpayers typically have the right to a hearing before any levy is enforced. However, some tax debtors may receive a levy notice only after their assets have been seized or transferred, in which case they are not entitled to a pre-deprivation hearing:

- When a collection of the tax is in jeopardy.

- When the IRS levies upon a state tax refund.

- When the criteria for a Disqualified Employment Tax Levy are met.

- When the IRS serves a federal contractor levy.

If someone who owes taxes doesn’t ask for a CDP (collection due process) in time, they can still request a CDP Equivalent hearing that is similar up to one year after getting a notice of levy.

Collection Appeals Program (CAP)

The CAP and CDP differ in terms of what they offer. Unlike the CDP, the CAP doesn’t allow taxpayers to challenge the amount or existence of their federal tax debt. Additionally, it doesn’t provide access to judicial remedies for taxpayers who disagree with the outcome on appeal. The CAP is generally used for disputing asset the seizure or for contesting the modified, rejected, or terminated installment agreement, or a wrongful levy.

Regarding installment agreements, the IRS is not allowed to take any action to seize assets until 30 days after rejecting or discontinuing the agreement. Therefore, if you file an appeal within 30 days, the IRS will not take any further action until the appeal process is completed. However, unlike the CDP process, any decision made through CAP is final and binding for both the IRS and the taxpayer. It can only be appealed in federal court under very specific circumstances.

Get a Free Case Review

Tax Relief Counsel is available to help you 24/7. Contact us now for assistance with your case.

Call Me Personally

How Our Tax Appeal Lawyer Can Help You

Founding attorney Ramy Shabana has abundant experience managing IRS appeals and can assist you in all of the following ways:

Trustworthy Guidance

Take advantage of our team’s deep knowledge of tax laws and the appeals process to ensure that you understand your options clearly.

Case Assessment

We’ll analyze your case thoroughly and identify key strengths and weaknesses to develop a strategic approach.

Forceful Representation

We can handle all communications with the IRS Appeals Division on your behalf, advocating for your interests every step of the way.

Evidence Preparation

Our team will assist you in gathering and organizing relevant documentation and evidence to effectively support your appeal.

Negotiation

Rely on our lawyer’s strong negotiation skills to achieve a favorable outcome for your case during discussions with the IRS.

Appeals Conference Representation

Ramy will represent you at the appeals conference, presenting your case persuasively and addressing any concerns raised.

Alternative Resolution

Explore alternative options like settlement agreements under our veteran guidance.

We’re dedicated to helping clients overcome the many procedural hurdles of the appeals process. With our knowledge and advocacy, you can have full confidence that your rights are protected and your interests are being represented effectively.

Why Choose

Tax Relief Counsel?

There are many good reasons to partner with Tax Relief Counsel. Here are just a few.

Personalized Approach

Receive tailored tax guidance and support that addresses your unique situation and goals.

Worldwide Assistance

Enjoy convenient access to our services from anywhere in the world.

Transparent Communication

Open, transparent communication is one of our top priorities; we aim to ensure that you remain informed and empowered at every stage.

Comprehensive Services

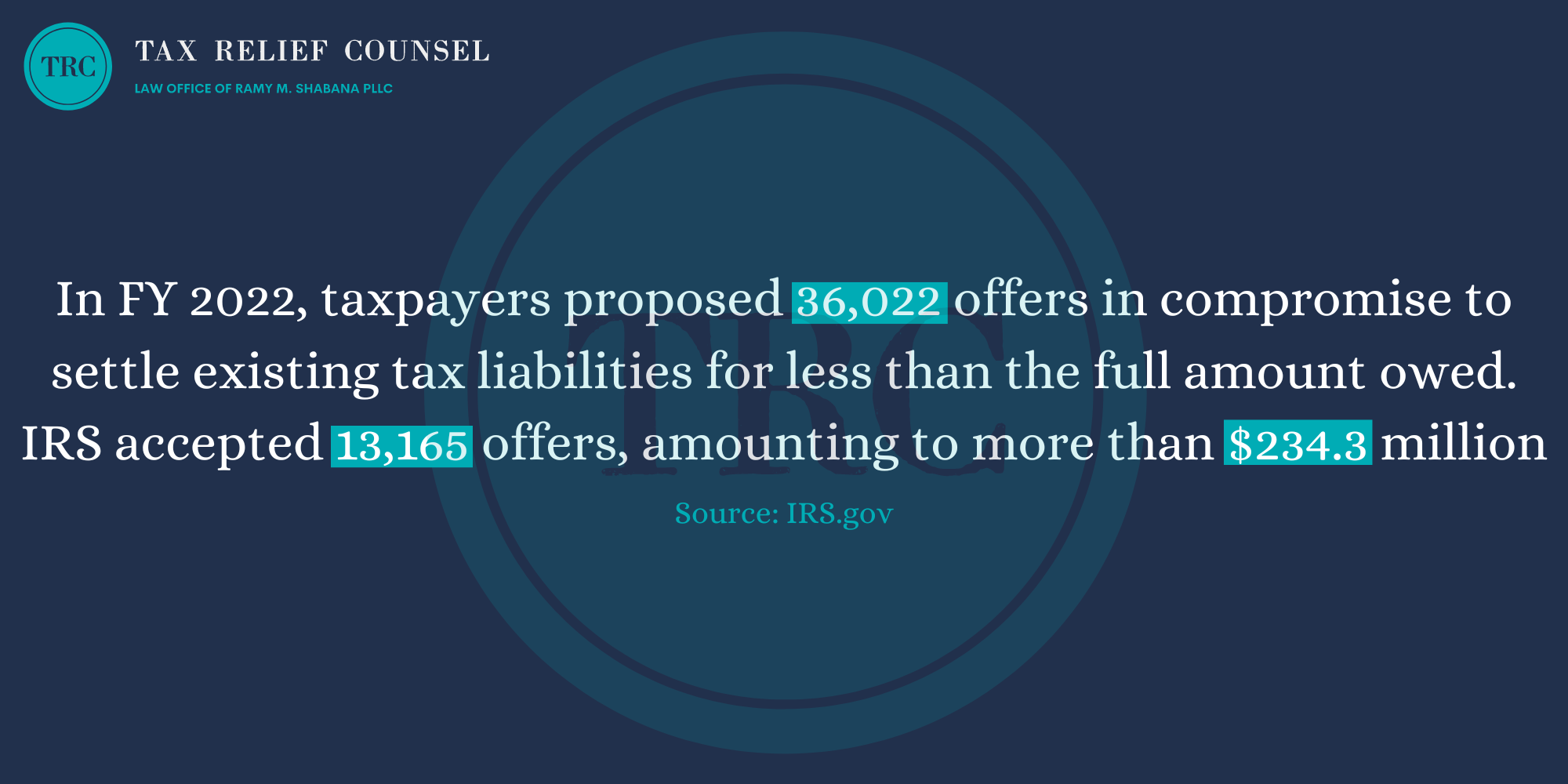

Avail yourself of our full range of tax relief services, from audits and appeals to installment agreements and offers in compromise.

FAQs

What is a tax appeal?

Tax appeals are a way to resolve a disagreement between the taxpayer and the IRS through mediation by the appeals office. Usually, this is done when the IRS makes adjustments to your tax return that you don’t agree with. Instead of accepting the adjustments and potentially paying more taxes, you have the option to disagree with the adjustments and create a formal written protest to submit to the IRS appeals office.

What changes to my taxes can be appealed?

In general, if the IRS makes any changes to your tax bill such as disallowing deductions or credits, adding penalties and interest, or announcing tax liens, levies, or seizures, you have the right to appeal. You can even appeal installment payment agreements and Offers in Compromise.

You can appeal any IRS notice that informs you about changes to your taxes and outlines your appeal rights. However, in order to win the appeal, you must provide a valid argument with supporting evidence to prove that the decisions made by the IRS are incorrect.

How Do I request a tax appeal?

In order to appeal your taxes, you need to write a formal letter expressing your disagreement with the decisions made and provide evidence to support your claims. After that, send the letter to the address listed in the letter that explains your rights to appeal.

If your tax case is not resolved by the IRS and your explanation is reasonable, it will be sent to the appeals office for further review. To request a tax appeal, you can either represent yourself or hire our IRS appeals lawyer in Washington DC. If you opt for the latter and want only your attorney to handle the matter, you need to complete Form 2848.

How Do I file a formal written protest for my tax appeal?

To appeal your taxes, you usually need to submit a written protest. The protest must include the following information:

- Your contact information (Name, Address, Phone Number).

- Drafted letter to the Office of Appeals indicating your wish to appeal the decisions made by the IRS.

- Copy of the letter you received from the IRS stating the changes.

- Tax period in which the changes are involved.

- A list of all the changes with which you disagree and the reasons you disagree with each change.

- Facts that support your disagreements with the changes.

- The penalties of perjury statement, “Under the penalties of perjury, I declare that the facts stated in this protest and any accompanying documents are true, correct, and complete to the best of my knowledge and belief”, signed by the individual requesting for the appeal.

You need to send the letter of protest within the time limit mentioned in the letter that explains your appeals rights. This time limit is usually 30 days from the date of the letter.

Reach Out Today!

Ready to take control of your tax situation? Contact us today for a free consultation. Our experienced team is here to help you navigate IRS procedures and find the best solution for your needs.